Table of Contents

Walmart Connect represents the most significant efficiency opportunity in retail media today. With 55% lower CPCs, 3× higher CTR, and 25% higher ROAS compared to Amazon, early-mover brands can establish dominant positions before competition intensifies. The platform’s unique advantages compound: closed-loop attribution tracking $500+ billion in annual transactions, in-store reach of 150 million weekly shoppers across 4,700+ locations, and first-party shopper data enabling precision targeting unavailable elsewhere.

Success requires systematic execution: master the seven ad format types and their optimal applications, build campaigns following the automatic-to-manual evolution, leverage Walmart’s unique algorithm by prioritizing attribute completion, implement three-tiered keyword strategies, track omnichannel ROAS to capture full advertising impact, and apply category-specific playbooks for vertical optimization. Talk to us at RMIQ – RMIQ accelerates time-to-results by unifying Walmart Connect management with 70+ other retail media networks, applying AI optimization across platforms, and providing performance-based pricing that aligns costs with outcomes.

Part 1: The Walmart Connect Ad Network

Market Position and Strategic Importance

Walmart Connect has solidified its position as the second-largest retail media network in the United States, generating approximately $4.4 billion in annual advertising revenue—a 27% year-over-year increase that signals a fundamental shift in how brands allocate digital advertising spend. This growth trajectory reflects the broader retail media revolution, where closed-loop attribution and first-party data have become essential competitive advantages in an era of cookie deprecation.

For professional advertisers, Walmart Connect’s ad network offers a compelling value proposition that distinguishes it from both traditional digital advertising and competing retail media networks. The platform’s unique strength lies in harmonizing massive first-party purchase data with a physical footprint of over 4,600 stores, reaching 150 million customers weekly—90% of the U.S. population lives within 10 miles of a Walmart store, creating an omnichannel attribution opportunity unmatched by any competitor.

Walmart Connect vs. Amazon Ads

Walmart Connect advertising has a key advantage: it lies in its lower costs and higher engagement rates compared to Amazon’s increasingly saturated marketplace. This efficiency gap represents a significant opportunity for brands willing to diversify their retail media investments.

| Metric | Walmart Connect | Amazon Ads | Advantage |

| Average CPC | $0.35–$0.75 | $0.85–$5.00+ | 55% lower |

| Click-Through Rate | 0.6–0.8% | 0.2–0.3% | 3× higher |

| Average ROAS | 4–6× | 3–4× | 25% higher |

| Omnichannel Attribution | Closed-loop (Online + In-Store) | Online only | Full visibility |

| Competition Level | Emerging/Fast Growth | Saturated/High | Early-mover opportunity |

Platform Developments in 2026

Several strategic developments have positioned Walmart Connect for 2026 growth:

- Vizio Integration: the $2.3 billion acquisition of Vizio brings SmartCast OS directly into Walmart Connect’s infrastructure, enabling household-level CTV targeting based on verified shopping behavior

- AI-Powered Tools: native AI assistants Marty (for advertisers) and Sparky (consumer-facing) provide conversational interfaces for campaign management and create new sponsored placement surfaces

- Expanded Self-Serve Capabilities: TV Wall ads and additional in-store formats are becoming accessible through the self-serve Ad Center, and note that Walmart is pushing advertisers in this direction: self-serve, rather than managed services

- Enhanced Measurement: search Incrementality solutions now measure true campaign contribution using first-party retail data and test-and-control methodologies

- Dynamic Bidding: automated bid adjustments of up to +100% when conversion is likely, with beta advertisers reporting up to 199% sales increases

Full-Funnel Synergy

The synergy between Walmart Connect’s ad formats creates measurable compounding effects. Shoppers exposed to both Sponsored Search and Onsite Display ads are up to 3× more likely to purchase and spend up to 40% more on advertised brands. This multi-format approach represents the cornerstone of modern retail media strategy, ensuring messaging follows consumers from initial discovery through final purchase.

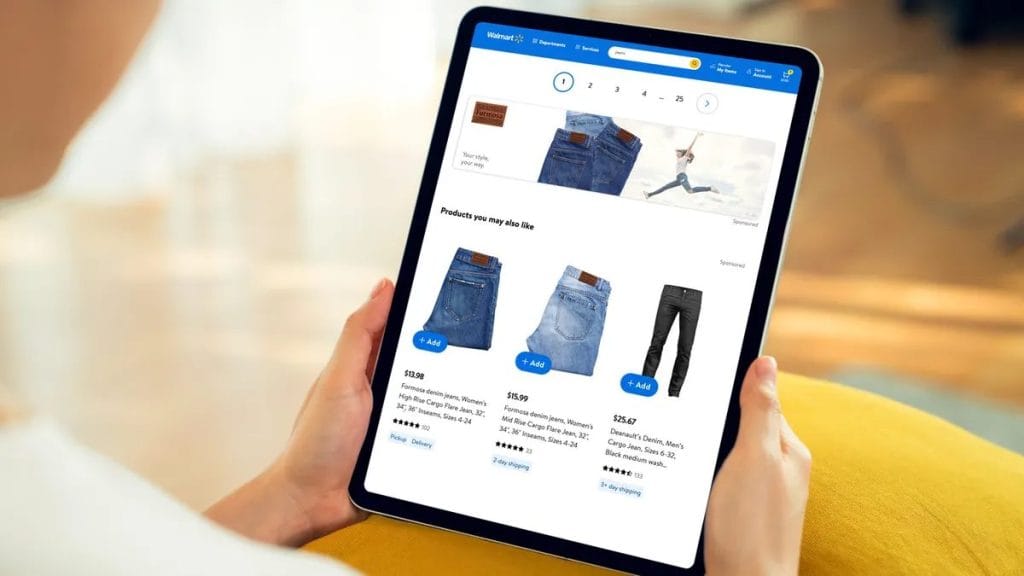

Part 2: Walmart Connect Ad Formats

Walmart Connect offers a comprehensive advertising ecosystem designed to influence shoppers at every touchpoint, from initial awareness through final purchase. Understanding the distinct characteristics, requirements, and strategic applications of each format is essential for maximizing return on ad spend.

2.1 Sponsored Products

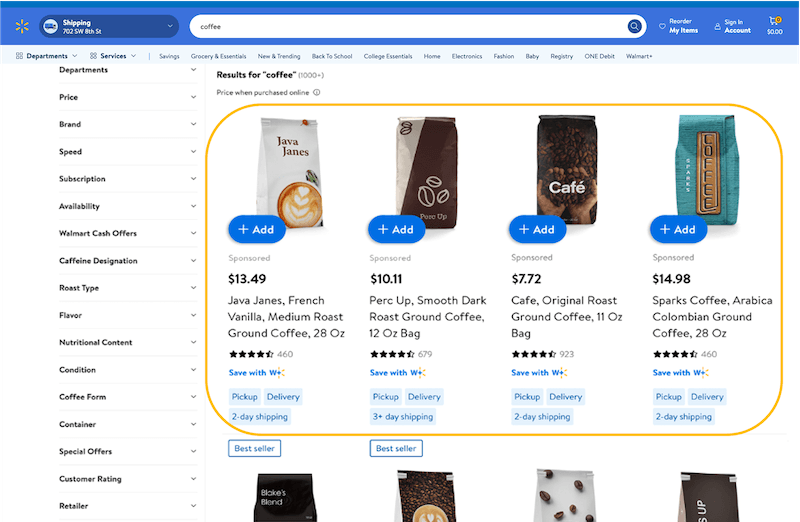

Sponsored Products are cost-per-click native ads that drive shoppers to product detail pages on Walmart.com. These ads represent the workhorse of the Walmart ad stack, allowing individual SKUs to appear in high-visibility placements across the site and app. They operate on a second-price auction model—you pay just above the second-highest bid—which fundamentally differs from Amazon and Google’s auction mechanics.

Placement Types and Strategic Applications

| Placement | Location | Strategic Objective |

| Search In-Grid | Top slots (1-4) and every 10 items in search results | Capture immediate search intent; establish category dominance |

| Item Carousels | “Customers also viewed” and “Related items” on PDPs | Drive cross-selling; capture comparison shoppers |

| Buy Box | Below “Add to Cart” button on competitor pages | Defensive brand protection or offensive conquesting; 6.0× avg ROAS |

| My Items In-Grid | Relevant category grids for logged-in repeat customers | Retention and loyalty-focused placement for consumables |

| Stock Up | Final stages of cart finalization | Increase basket size; prompt replenishment purchases |

Campaign Specifications

| Specification | Automatic Campaign | Manual Campaign |

| Minimum Bid | $0.20 | $0.30 |

| Minimum Daily Budget | $100 | $100 |

| Minimum Monthly Spend | $1,000 | $1,000 |

| Targeting | Algorithm-selected keywords | Advertiser-selected keywords |

Product Eligibility Requirements

- Products must be in-stock with Buy Box ownership

- Organic ranking within top 128 results for targeted search term

- Listing Quality Score above 80% recommended for optimal ad performance

- Products with poor customer ratings or restricted categories cannot advertise

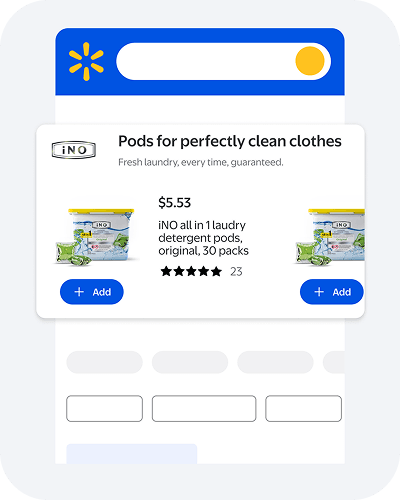

2.2 Sponsored Brands

Sponsored Brands appear as premium keyword-targeted placements featuring a brand logo, custom headline, and up to four products at the very top of search results. These ads serve mid-to-upper funnel objectives by providing curated brand storytelling. In fiscal 2025, nearly 46% of all orders from Sponsored Brands came from new-to-brand buyers, making it a powerful customer acquisition tool.

Creative Specifications

- Brand logo: 300 × 180 pixels, PNG format, clear and non-pixelated

- Brand name: Maximum 35 characters including spaces

- Headline: Maximum 45 characters; no competitor brand names allowed

- Minimum bid: $1.00 (significantly higher than Sponsored Products)

- Minimum campaign budget: $50

Eligibility Requirements

- Brand registration with Walmart Brand Portal

- Rights ownership registered with U.S. Patent and Trademark Office

- Sellers must be based in US, Canada, China, Hong Kong, or UK

- Approval typically takes 24-48 hours; submit creative 3-5 days before launch

Performance Insights

Campaigns see significant performance lift from week one to week four as relevancy builds. Combining Sponsored Brands with Sponsored Products increases conversion rates by 30% compared to running Sponsored Products alone.

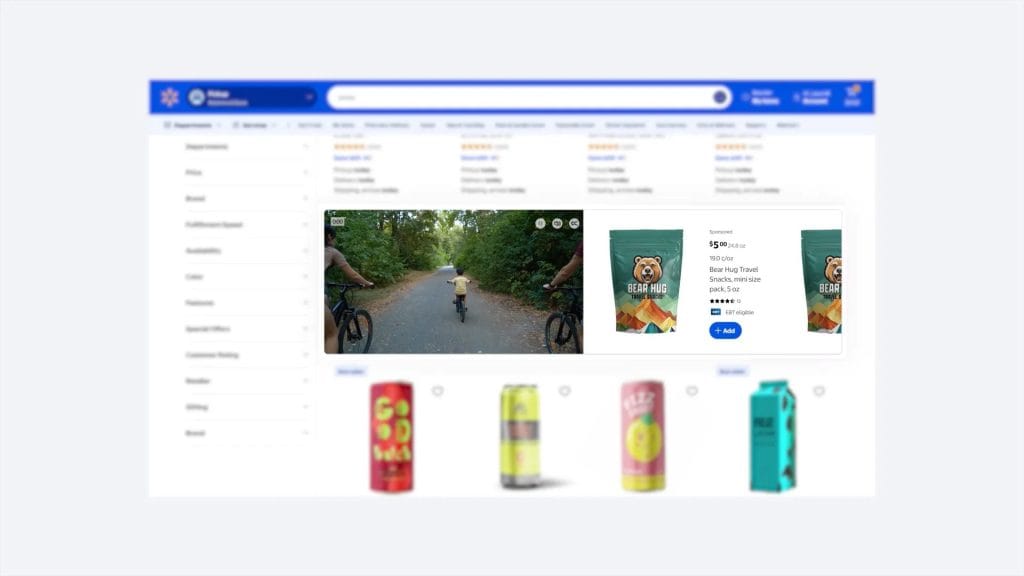

2.3 Sponsored Videos

Sponsored Videos appear within search results as premium placements designed to boost awareness through visual storytelling. Products with video content see 85% higher engagement rates than those without, making video essential for categories where product demonstration is key. Among SMB advertisers, 91% of attributed sales from Sponsored Videos come from new-to-brand customers.

Technical Requirements

| Specification | Requirement |

| Length | 5–30 seconds |

| Aspect Ratio | 16:9 |

| Resolution | 1920×1080 to 3840×2160 pixels |

| File Size | Up to 500 MB |

| Format | MP4 or MOV |

| Closed Captions | Required for spoken word (ADA compliance) |

| Minimum Bid | $0.80 |

| Minimum Daily Budget | $50 |

Creative Best Practices

- Design visual-first since videos play muted by default

- Showcase the product within the first 3 seconds

- Communicate the core message within 5 seconds

- End with a brand logo since videos loop automatically

- Well-optimized campaigns generate 4.2× ROAS compared to 2.1× for sponsored search alone

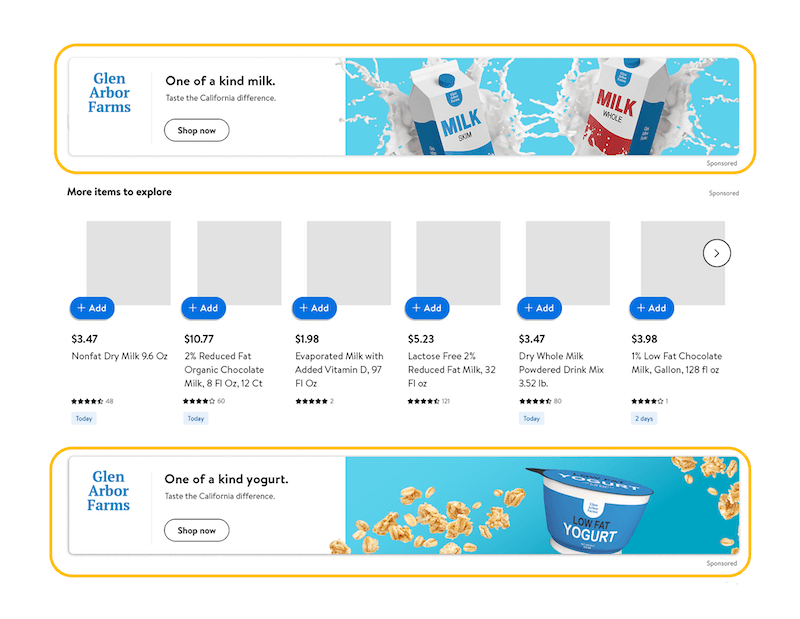

2.4 Onsite Display

Onsite Display consists of eye-catching banner ads on Walmart’s site and app using precise audience targeting. Unlike Sponsored Search, which follows a second-price auction model, Onsite Display utilizes an eCPM (effective cost per mille) first-price auction—you pay your winning bid amount per thousand impressions.

Targeting Options

- Behavioral targeting: Based on Walmart purchase history (online and in-store)

- Contextual targeting: Keyword search and category browsing history

- Custom and lookalike audiences: Based on first-party data uploads

- Weather-based targeting: Via IBM Watson integration

- Run of site: For broadest visibility

Display Placement Types

- Marquee Ads: Premium homepage, search, and browse page placement

- Skyline: Top of search pages for maximum visibility

- Gallery: Product carousels across the site

- Carousel Ads: Multiple products with hero image and “Shop Now” button

- Brand Box: Sticky placement on desktop item pages

- Category Ads: Appear while shoppers browse relevant digital aisles

Recommended minimum budget: $4,500 per campaign per month for meaningful results. Campaigns using Sponsored Search and Display together see a 3× average increase in orders for Food & Consumables categories, with Onsite Display showing up to 60% higher iROAS than Offsite Display for Food & Beverage.

2.5 Offsite Display (Walmart DSP)

Walmart’s Demand-Side Platform, built in partnership with The Trade Desk, extends advertising reach beyond Walmart properties across display, streaming video, mobile, audio, Connected TV, gaming apps, native, and rich media formats.

Media Partnerships

VIZIO, NBCUniversal, Meta, TikTok, Roku, and Disney+/Hulu/ESPN+—providing access to premium inventory while leveraging Walmart’s first-party shopper data for targeting.

Targeting Capabilities

- Historical buyers of specific brands, categories, or items

- Pre-built high-intent audiences from Walmart search and browse behavior

- Predictive audiences likely to purchase during campaign lifecycle

- Cross-device and geographical targeting

- Retargeting users who added items to cart or visited brand pages

Closed-loop measurement tracks attribution from ad exposure to purchase across both online and in-store channels. Advertisers using buyer reports see up to 29% more new customers, while rest-of-market analysis shows an average 4.8% sales lift outside Walmart stores—demonstrating advertising’s halo effect.

2.6 Connected TV (CTV) and Vizio

The 2024 Vizio acquisition has fundamentally altered the retail media landscape by integrating SmartCast OS directly into Walmart Connect’s infrastructure. This creates a “living room experience” where TVs become shoppable storefronts. CTV ads can be targeted based on verified Walmart shopping behavior.

CTV Format Types

| Format | Placement | Performance Potential |

| Home Screen Takeover | Immediate visibility when TV is powered on | 2× higher purchase intent vs. single-format |

| WatchFree+ Channels | Integrated into ad-supported streaming | High brand recall and storytelling |

| Pause Ads | Interactive prompts when content paused | Contextual, non-disruptive high-intent moments |

| Shoppable Video | AI prompts generating QR codes | Direct bridge from discovery to checkout |

Strategic value: Shoppers exposed to CTV ads are 28% more likely to eventually purchase products through Walmart Connect search channels. This “multi-screen” approach ensures messaging follows consumers from the couch to the cart.

2.7 In-Store Advertising

Walmart’s in-store advertising ecosystem reaches approximately 150 million customers weekly across 4,600+ U.S. stores through digital screens, audio, and experiential placements—delivering “Super Bowl-sized audiences every week.”

In-Store Format Types

- TV Wall Placements: 170,000+ digital screens in Electronics departments; self-serve coming to Ad Center

- Self-Checkout Screen Ads: High visibility at point of purchase; up to 5% sales lift for Food suppliers

- Walmart Radio: 30-second audio spots across all U.S. Walmart and Sam’s Club locations

- In-Store Demos: Expanded from 25 pilot stores to 120+ locations with QR code integration

2.8 Brand Shop and Shelf

Brand Shop provides a free virtual storefront exclusive to each registered brand—SEO-optimized for Google search ranking with a custom shareable URL. Shelf pages serve as digital aisles showcasing curated product collections. Both are free to build and maintain through Walmart Connect Ad Center’s Shop Builder.

Eligibility Requirements

- Rights ownership registered with U.S. Patent and Trademark Office

- At least one brand registered with Walmart Brand Portal

- Minimum 6 in-stock product SKUs

- Based in US, Canada, China, Hong Kong, or UK

Part 3: Campaign Setup and Management

3.1 Campaign Architecture Best Practices

Campaign structure directly impacts performance scalability and optimization efficiency. The recommended approach creates unique campaigns for each base item to maximize bidding control, with four ad groups per campaign segmented by keyword type: generic, brand, competitor, and marketplace keywords.

Product Tiering Strategy

| Tier | Characteristics | Bid Strategy |

| Tier 1 | High-margin, high-conversion SKUs with full inventory and optimized PDPs, 4+ star ratings | Aggressive CPC bids |

| Tier 2 | Emerging or seasonal SKUs with moderate performance potential | Medium bids, testing |

| Tier 3 | Low-margin, low-conversion SKUs or operationally constrained | Minimal spend unless strategic |

Naming

Use descriptive and consistent naming that clearly identifies goals, campaign type (Auto/Manual), product category, and targeting strategy. Example: “Q2 Summer Sale – Sponsored Products – Auto – Kitchen Appliances.”

3.2 The Automatic-to-Manual Campaign Evolution

New advertisers should begin with an 80% automatic / 20% manual budget split, transitioning toward 45% automatic / 55% manual as campaigns mature. Manual campaigns ultimately generate approximately 60% of total sales once optimization is complete.

Automatic Campaigns Excel in this:

- Keyword discovery for new brands without extensive research

- New product launches requiring market signal gathering

- Expanding reach beyond existing customer bases

- Always-on visibility with minimal management

Manual Campaigns Provide this:

- Precision control over keyword selection and bids

- Match type segmentation (broad, phrase, exact)

- Better cost efficiency on proven converting terms

- Higher relevancy scores through targeted optimization

The Harvesting Process

- Launch automatic campaigns with conservative item-level bids

- Collect performance data for minimum 2-4 weeks

- Download Item Keyword Performance Reports regularly

- Identify converting keywords with strong ROAS and sufficient volume

- Add winners to manual campaigns as exact match keywords

- Continue running both campaign types—automatic for discovery, manual for precision

3.3 Budget Allocation Frameworks

Minimum Budget Requirements by Format

| Ad Format | Minimum Budget |

| Sponsored Products | $100 daily / $1,000 monthly |

| Sponsored Brands | $50 per campaign |

| Sponsored Videos | $50 daily |

| Onsite Display | $4,500 monthly recommended |

The 60/30/10 Rule for New Advertisers

- 60%: Automatic campaigns for discovery and algorithm learning

- 30%: Manual campaigns for precision on proven terms

- 10%: Sponsored Brands for awareness and brand building

Budget Pacing Best Practices

- Unused daily budgets roll over up to 2× the daily limit

- Increase budgets by 10-15% weekly rather than sudden large jumps

- Monitor pacing to prevent budget exhaustion before peak shopping hours (7-10 PM local)

- Reserve 20-30% of total budget for ongoing optimization, testing, and contingency

3.4 The Retail Readiness Framework

Successful advertising on Walmart starts long before campaign launch. “Retail readiness” refers to the foundational health of a product listing, which the Walmart algorithm uses to determine ad eligibility and placement. Ad spend on unoptimized listings is often wasted.

Critical Readiness Factors

- Inventory and Buy Box Ownership: Ads for out-of-stock products or those not winning Buy Box will be suppressed; stock-outs degrade organic ranking

- Listing Quality Score (LQS): Aim for above 80%; key components include optimized titles (under 50 characters for mobile), high-resolution images (minimum 1500×1500px), and detailed attribute mapping

- Pricing Strategy: Walmart’s algorithm is extremely price-sensitive; products priced higher than competitors may lose Buy Box eligibility

- Fulfillment Speed: Walmart Fulfillment Services (WFS) provides “2-Day Delivery” tags, significantly improving conversion rates

3.5 Seasonal Campaign Planning

Key Walmart Shopping Events

- Walmart Deals Holiday Kickoff (October): 67% of Walmart shoppers start holiday planning

- Black Friday / Cyber Monday (November): Biggest conversion opportunity

- Walmart+ Week (varies): Exclusive member deals

- Deal Days (competing with Prime Day): Major promotional event

- Back-to-School (July-August): Key for apparel, supplies, tech

Seasonal Roadmap

| Month | Strategic Priority | Tactical Implementation |

| October | “Seed-Planting” & Awareness | Launch Sponsored Video and Display for brand familiarity |

| November | High-Intent Conversion | Shift budget to Sponsored Products and Exact Match keywords |

| December | Last-Minute Gift Shoppers | Focus on WFS items for guaranteed delivery; Stock Up placements |

| January | Retention and New Habits | Target “New Year” categories; My Items placements for repeat buys |

Part 4: Keyword Strategy and Research

4.1 Understanding Walmart’s Polaris Algorithm

Walmart’s search algorithm operates fundamentally differently from Amazon’s A10, with item completeness weighted at 40% versus Amazon’s 10-15%—making structured product data the single most important ranking factor. This distinction has profound implications for keyword strategy.

Polaris Algorithm Weights

| Factor | Weight | Description |

| Item Completeness | 40% | Product attributes and structured data |

| Performance Metrics | 30% | Conversion rate and customer satisfaction |

| Competitive Pricing | 20% | Total price including shipping vs. competitors |

| Content Quality | 10% | Relevance and recency of listing content |

Key Differences from Amazon

- Walmart penalizes keyword stuffing—titles should be 50-75 characters versus Amazon’s 150-200

- Walmart requires exact phrase matches more strictly for ranking

- Walmart rewards operational metrics (on-time delivery, inventory reliability)

- Listing Quality Score significantly impacts ad relevancy and placement eligibility

4.2 Keyword Research Tools and Methodologies

RMIQ offers a Free Walmart Keyword Research Tool, with cross-network learning and AI optimization. Check it out below and try it out when planning out your in-house walmart ad campaigns.

Official Walmart Tools

- Keyword Analytics Tool: Monitor high/medium/low traffic volume in Seller Center

- Search Query Report: Actual customer search terms with impression share and sales data

- Search Insights Dashboard: Search funnel performance and keyword recommendations

- Suggested Keywords Feature: Frequently-searched keywords for manual campaigns

Walmart Keyword Planner Mechanics

The Keyword Planner utilizes a 120-day data window to categorize keywords based on two metrics:

- Item Keyword Frequency: Measures “Item-Level Relevance”—how often your product appears in search results for a term

- Traffic Keyword Frequency: Measures “Customer Search Demand”—total searches for that keyword

The strategic objective is to identify “High-High” opportunities—keywords with massive search volume where your product already has high relevance. For “Low-High” scenarios (low relevance, high demand), prioritize listing optimization before increasing bids.

4.3 Match Type Strategies

Match Type Definitions and Performance

| Match Type | Behavior | Avg Conv. | Bid Level |

| Broad | Variations, synonyms, misspellings, related searches | 1.9% | Lowest |

| Phrase | Exact phrase with additional words before/after | 2.8% | Medium |

| Exact | Only exact keyword matches | 4.2% | Highest |

Important: Walmart’s match types are stricter than Amazon/Google—the platform heavily favors listings with exact phrases present in the content.

4.4 Brand Term Targeting

Brand Term Targeting, launched January 2024, enables advertisers to bid on competitor brand keywords for Sponsored Products, Sponsored Brands, and Sponsored Videos.

Key Constraints

- First two ad positions reserved for the targeted brand (brand defense)

- Conquesting brands appear in position 3 and below

- Limited to exact match keywords only

- Walmart private labels cannot participate

Three-Tiered Keyword Performance

| Keyword Tier | Conversion Rate |

| Branded Terms (own brand) | 4.2% (highest) |

| Category Terms | 2.8% |

| Competitor Terms | 1.9% |

Campaigns using all three tiers achieve 45% better overall results.

Part 5: Bidding and Budget Optimization

5.1 Understanding Walmart’s Auction Model

Walmart’s second-price auction for Sponsored Products differs fundamentally from Amazon and Google. The highest relevant bidder wins but pays just above the second-highest bid—reducing CPC and improving ROAS while encouraging advertisers to bid their true maximum value.

Implications of Second-Price Auctions

- Lower actual CPC than bid amount

- Reduced risk of overpaying

- Confidence to submit aggressive bids without waste

- Relevancy can win with lower bids against less relevant higher bidders

5.2 Bidding Strategies

Placement Bid Modifiers

Search in-grid position 1 shows add-to-cart rates 6× higher than positions 2-10—justifying aggressive multipliers for premium placements. Top-of-search positions are critical; add-to-cart rate is 4× higher in top 4 positions.

Dynamic Bidding

Dynamic bidding adjusts bids in real-time based on conversion likelihood: up to +100% increase when conversion is likely, down to -50% decrease when unlikely (never below floor price). Brands using dynamic bidding during beta reported up to 199% sales increases.

Target ROAS Bidding

Set your desired ROAS target and the algorithm manages bids accordingly—ideal for large catalogs where manual micromanagement isn’t feasible. Allow a learning period of 2-3 weeks before making drastic changes. Target ROAS campaigns achieve at least 85% of their goals.

5.3 CPC Benchmarks by Category

| Category | Walmart CPC | Amazon CPC |

| Health & Household | $0.35–$0.75 | $2.23 |

| Beauty & Personal Care | $0.60–$1.00 | $1.53 |

| Grocery | $0.60–$0.80 | $1.34–$1.50 |

| Electronics | $0.60–$1.20 | $1.00–$3.00 |

| Fashion | $0.50–$1.50 | $0.80–$2.00 |

Part 6: Performance Measurement and Analytics

6.1 Core Metrics

ROAS (Return on Ad Spend)

ROAS = Total Attributed Sales ÷ Total Ad Spend.

Walmart Marketplace sellers typically see an average ROAS of 5:1. Good ROAS targets range from 3× or higher.

ACOS (Advertising Cost of Sales)

ACOS = Total Ad Spend ÷ Total Attributed Sales × 100.

ACOS is the inverse of ROAS and measures the percentage of sales consumed by advertising costs. Target: ACOS below gross margin threshold.

Incrementality (iROAS)

This metric measures the sales that advertising actually caused, separating them from “recycled demand” (customers who would have bought anyway via organic search). As the industry enters 2026, the performance gap between retail media leaders and laggards is defined by their ability to measure causal impact rather than just correlation.

6.2 ROAS Benchmarks by Ad Type

| Ad Type | Typical ROAS | Notes |

| Sponsored Products | 3–5× | Buy Box placements average 6.0× |

| Sponsored Brands | 2–4× | 3.2× higher return vs SP on lower CPC |

| Sponsored Videos | 2–4× | 91% of sales from new-to-brand customers |

| Onsite Display | 1.5–3× | Assist conversions captured by SP |

| Buy Box Placement | 6.0× | Highest return across all placements |

6.3 Omnichannel ROAS: Capturing the Full Picture

Walmart’s closed-loop attribution tracks advertising impact from exposure to purchase across both online and in-store channels—a capability Amazon cannot match.

Omnichannel ROAS Calculation

Omnichannel ROAS = (Online Sales + In-Store Sales + Pickup + Delivery) ÷ Ad Spend

In-Store Attribution Methodology

- In-Store Advertised Sales: Customer clicks ad, buys exact product in-store

- In-Store Other Sales: Customer clicks ad, buys different product from same brand (halo effect)

- In-Store Attributed Sales: Combined total

Impact: omnichannel ROAS typically increases by ~20% when including in-store data. Some brands see ROAS increase by 30%+ with in-store attribution. According to Walmart surveys, 81% of consumers look at the Walmart app/site before store purchase, and 76% are likely to buy products seen online in physical stores.

6.4 Attribution Windows

| Window | Best For |

| 3-day | Quick purchases, grocery, household items |

| 14-day (default) | Standard click-based attribution |

| 30-day | Longer consideration cycles, home goods, high-ticket items |

Walmart uses last-touch attribution within its ecosystem. If multiple Walmart Connect ads contributed to a conversion, the last touchpoint receives credit. This means upper-funnel formats (display, CTV) may appear to underperform while Sponsored Products capture credit for assisted sales.

Part 7: Category-Specific Playbooks

7.1 Consumer Packaged Goods (CPG) Ads on Walmart Connect

Consumer Packaged Goods represent Walmart’s core strength, with grocery comprising 56%+ of net sales. Walmart leads in omnichannel grocery with 68% penetration among lower-income households. CPG CPCs remain exceptionally efficient at $0.40–$0.80 versus Amazon’s $1.30–$1.50.

Strategic Priorities

- Proximity to Purchase: Walmart Connect is more effective at driving Walmart sales than geo-targeted social campaigns

- Omnichannel Integration: ROAS increases ~20% with in-store attribution

- Replenishment Focus: Target “reorder” section placements for consumable products

- Private Label Defense: Optimize PDPs to appear organically before competitors can conquest

Recommended Format Allocation

- Sponsored Products: 55-65% (high-intent conversion, category defense)

- Sponsored Brands: 15-20% (category awareness, brand discovery)

- Sponsored Videos: 10-15% (new launches, emotional storytelling)

- Onsite Display: 10-15% (retargeting, new customer acquisition)

Target Benchmarks

- ROAS: 4.0–6.0×

- ACOS: 15–25%

- CTR: 0.3–0.8%

- CPC: $0.40–$0.80

- Conversion: 2.5–4.2%

7.2 Electronics Ads on Walmart Connect

Electronics involves extended research and consideration cycles, with 75% of Walmart customers shopping online to compare items. Video advertising is critical for demonstrating features and differentiating brands. Competition is higher, driving CPCs to $0.60–$1.20.

Approach

- Extended Consideration: Run campaigns 4-6 weeks before purchase events

- Multi-Touchpoint Strategy: Display → Video → Sponsored Products funnel

- Video Emphasis: 71% of electronics shoppers agree effective ads should “look and sound like entertainment”

- Video campaigns generate 4.2× ROAS versus 2.1× for search alone

Recommended Format Allocation

- Sponsored Products: 40-50% | Sponsored Videos: 20-25% | Sponsored Brands: 15-20% | Onsite Display: 15-20% | CTV: 5-10%

Target Benchmarks

- ROAS: 5.5–8.3×

- ACOS: 12–18%

- CTR: 0.4–0.9%

- CPC: $0.60–$1.20

- Conversion: 2.5–4.0%

7.3 Health and Beauty Ads on Walmart Connect

Health & Beauty shows the strongest growth on Walmart Connect, with 69.4% YoY performance improvement. The category delivers excellent efficiency with ROAS of 6.7–10×—the highest-performing vertical.

Regulatory Compliance

- Advertising must be truthful and supported by scientific evidence

- Claims like “reduces wrinkles” or “treats eczema” constitute drug claims requiring FDA approval

- Structure-function claims (“moisturizes skin”) are acceptable; treatment claims are not

Target Benchmarks

- ROAS: 6.7–10×

- ACOS: 10–15%

- CTR: 0.4–0.8%

- CPC: $0.35–$0.75

- Conversion: 3.0–5.0%

7.4 Grocery Ads on Walmart Connect

Grocery represents 56%+ of Walmart’s net sales—the company’s #1 category. Walmart leads in omnichannel grocery with industry-best pickup and delivery infrastructure. CPCs remain remarkably efficient at $0.60–$1.00.

Target Benchmarks

- ROAS: 5.0–7.0×

- ACOS: 15–20%

- CTR: 0.2–0.4%

- CPC: $0.60–$1.00

- In-Store Lift: 5–10%

Part 8: Advanced Automation and AI

8.1 Walmart’s Native AI: Marty and Sparky

The transition to an “AI-first” retail media model is the defining theme of 2026. Walmart Connect has deployed two primary AI agents to streamline the platform experience.

Marty (Advertiser Assistant)

An “agentic” assistant that allows advertisers to ask questions in natural language about topics like bidding, keywords, and billing. It provides personalized recommendations and “Change Analysis” reports. Notably, 97% of Marty’s user queries have been unique, indicating it’s being used to solve highly specific campaign challenges.

Sparky (Shopping Assistant)

A consumer-facing assistant that helps shoppers find products, check availability, and receive recommendations. For advertisers, Sparky represents a new “Conversational Search” surface where ads appear as sponsored prompts within recommendations.

Part 9: RMIQ’s Capabilities on Walmart Connect

While native tools like Marty are primarily reactive (responding to user questions), RMIQ’s agents are “always-on” and predictive. The platform employs a multi-agent AI architecture with autonomous specialists handling different optimization functions.

- Network Optimizer Agent: automatically adjusts spend based on real-time performance data across Walmart, Instacart, Target, and Amazon, ensuring budget flows to channels with highest marginal return

- Automated Budget Allocation: dynamically distributes budgets across networks and campaigns based on SKU-level demand, margin, and competition; prevents overspending during low-liquidity windows

- Predictive Placement Selection: identifies top-performing placements and predicts which positions will drive best ROI, adjusting bids before performance data confirms the opportunity

- Dynamic Bid Adjustments: calibrates floor and ceiling bids at the SKU level with pacing algorithms smoothing spend volatility while protecting margins

- Cross-Network Learning: propagates insights across all integrated networks—learnings from Amazon campaigns inform Walmart optimization, and vice versa

- A/B Testing Orchestration: runs autonomous creative tests, measures decay rates, and alerts when ad performance starts declining

Unified Management Across Supported Networks

RMIQ solves the fundamental challenge of retail media fragmentation—managing campaigns across dozens of disconnected platforms with different interfaces, metrics, and optimization tools. RMIQ is a “Pay Only for Results” model with flexible pricing structures that reduce risk for advertisers testing retail media expansion. No contract required; free trial available. Special programs include $1,000 free campaign grants for female and Black-owned startups.

- Mass Retailers: Walmart Connect, Target Roundel, Costco

- Grocery: Kroger, Whole Foods, Sprouts, Albertsons, Food Lion

- Delivery/Marketplace: Amazon Ads, Instacart, DoorDash, Uber Eats, GoPuff, Shipt

- Pharmacy/Convenience: CVS, Walgreens, 7-Eleven, Wawa

- Department Stores: Macy’s, Nordstrom, JCPenney, Kohl’s

- Specialty: Home Depot, Lowe’s, Best Buy, Chewy, Staples

Walmart-Specific Capabilities

- Direct API integration with Walmart Connect

- Free Walmart Keyword Research Tool

- Support for CPM, CPC, and ROAS-based campaigns

- Real-time campaign optimization and validation

- Integration with Walmart Luminate/Scintilla insights

Part 10: Implementation Roadmap

Pre-Launch Checklist and Weekly Launch Plan

- Products in stock on Walmart.com with Buy Box ownership

- Listing Quality Score above 80%

- At least 6 SKUs for Brand Shop eligibility

- Brand registration with Walmart Brand Portal (for Sponsored Brands/Videos)

- Competitive pricing including shipping costs

- Quality product images meeting specifications (1500×1500 minimum)

Week 1: Foundation

- Set up Walmart Connect Ad Center account

- Audit listing quality across all products

- Identify 10-15 strong-performing SKUs for initial campaigns

- Establish ROAS targets based on product margins

Week 2: Campaign Launch

- Launch automatic campaigns with $100/day budget per campaign

- Set conservative item-level bids to gather data

- Enable all placement types for maximum discovery

- Implement campaign naming conventions

Weeks 3-4: Optimization Begins

- Review search term reports for converting keywords

- Begin keyword harvesting process

- Identify underperforming products for exclusion

- Adjust bids based on initial performance data

Month 2: Scaling

- Launch manual campaigns with harvested keywords

- Test Sponsored Brands for brand awareness

- Implement three-tiered keyword strategy (brand, category, competitor)

- Begin A/B testing creative elements

10.3 Ongoing Optimization Cadence

- Daily: Monitor budget pacing and major performance changes

- Weekly: Download reports, adjust bids, harvest keywords

- Monthly: Rotate creative, update negative keywords, review strategy

- Quarterly: Full strategy review, seasonal planning, incrementality analysis

The brands establishing Walmart Connect expertise today will own the competitive advantages of tomorrow. Lower costs, higher engagement, and closed-loop measurement create a platform environment where excellence compounds—rewarding advertisers who commit to mastery with sustainable efficiency advantages their competitors cannot easily replicate.