Table of Contents

A Guide from First Campaign to Full-Funnel Mastery for Brand Owners, Sellers, and Experienced Advertisers transitioning from Google, Meta, and TikTok.

Amazon Ads are a sophisticated ecosystem generating over $50 billion annually—making it the 3rd-largest digital advertising platform globally, trailing only Google and Meta. For brands selling on Amazon, advertising is no longer optional; it’s the primary lever for visibility, sales velocity, and sustainable growth.

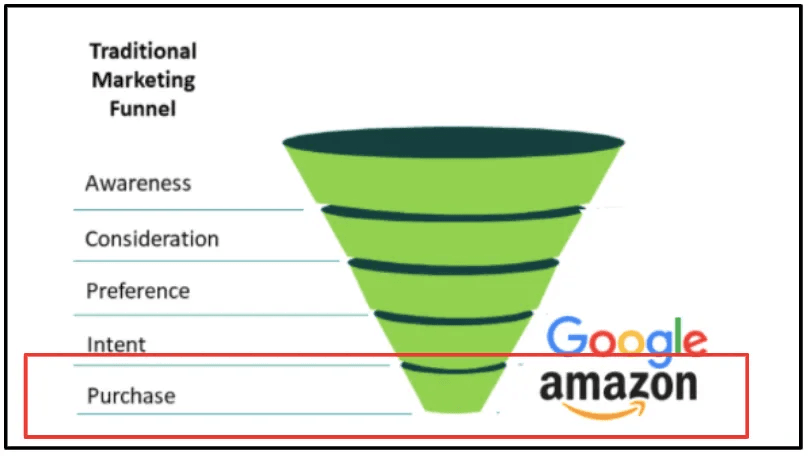

The advertising landscape on Amazon operates fundamentally differently from other digital platforms. Where Google captures searchers with varied intent and Meta targets users based on interests and behaviors, Amazon reaches customers at the precise moment of purchase decision—55% of all U.S. product searches now begin on Amazon, and these searchers arrive with wallets open. Understanding this distinction is the foundation upon which all successful Amazon advertising strategies are built.

Ads on Amazon

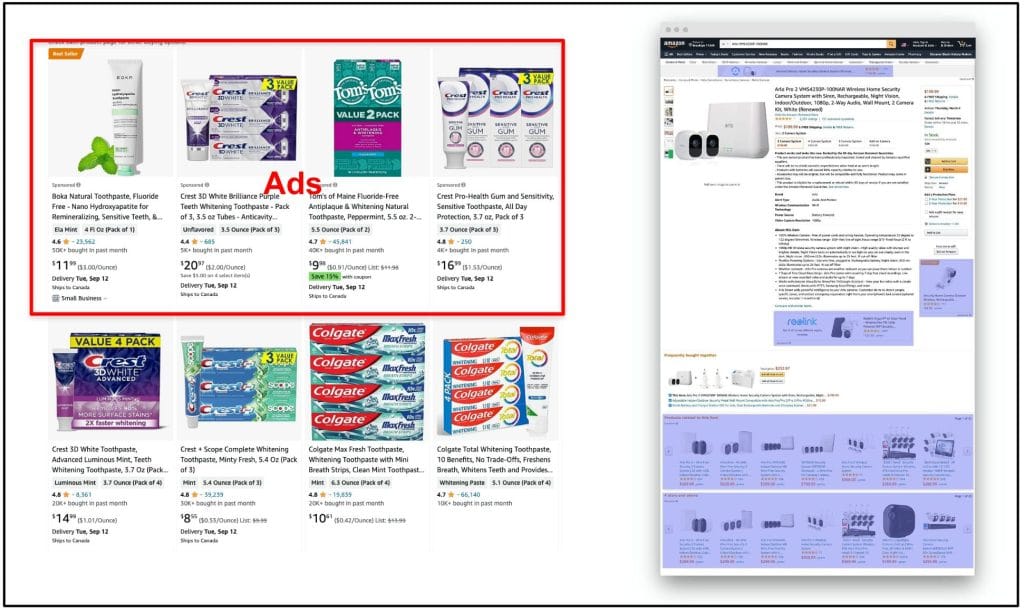

A few years back Marketplace Pulse published an article titled “Everything on Amazon is an Ad”. A review of Amazon’s platform confirms this headline. If you look at search results (LEFT side) on the left below you see a search for “toothpaste”, with the first 4 results returning sponsored products (depending on the product, the first 3-7 search results can be ads) and the second set being the actual search results (simpler than Google, but essentially similar). If you look at the product page (RIGHT side) on the right below is a product page for speakers. Everything shaded in blue is ad inventory targeting you based on data.

This guide follows the MECE (Mutually Exclusive, Collectively Exhaustive) framework, ensuring each section covers distinct territory without overlap while collectively addressing every aspect of Amazon advertising mastery. Whether you’re launching your first campaign or transitioning expertise from Google, Meta, or TikTok, this comprehensive resource provides the roadmap for success.

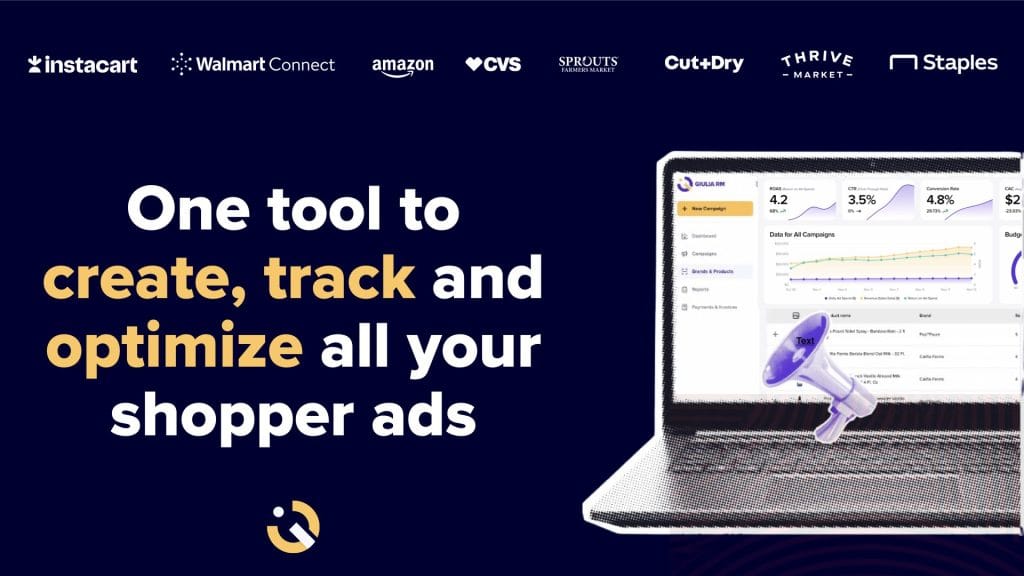

At RMIQ we’re experts in adtech, AI and running ad campaigns across retail media ad networks. We’ve structured this guide to serve newcomers who need foundational knowledge, and experienced digital advertisers who can navigate directly to platform-specific nuances and advanced strategies. Every section builds toward a complete understanding of how to profitably advertise on Amazon in 2026 and beyond.

ACHIEVING AMAZON AD SUCCESS

Success on Amazon is not about outspending competitors. It’s about understanding the system, building sustainable advantages through organic rank improvement, and continuously optimizing based on data rather than assumptions. This guide provides the framework. Execution—informed by your specific products, categories, and customers—determines results.

For Newcomers: start with Sponsored Products automatic campaigns to learn what converts, migrate winners to manual campaigns with increasing match type precision, and build systematically from proven data rather than assumptions. Accept that learning requires investment, but ensure that investment generates actionable intelligence.

For Experienced Advertisers Transitioning: respect Amazon’s differences from other platforms. The organic-paid feedback loop changes fundamental strategy. Your listing IS your landing page. TACoS matters more than ACoS for long-term business health. Apply your existing skills to Amazon’s unique context rather than assuming direct translation.

For All Advertisers: retail readiness precedes advertising success. Optimized listings, review velocity, Featured Offer ownership, and inventory availability gate advertising effectiveness. No amount of advertising spend overcomes fundamental product or listing problems.

Check out: Amazon’s Understanding Amazon Ads Guide

PART 1: UNDERSTANDING THE AMAZON ADVERTISING ECOSYSTEM

Before diving into campaign tactics and optimization techniques, it’s essential to understand the structural forces that make Amazon advertising uniquely powerful—and uniquely different from other digital platforms. This foundational knowledge will inform every strategic decision you make, from budget allocation to bidding strategy to format selection.

Amazon’s advertising ecosystem has reached an inflection point. What began as a simple pay-per-click product promotion tool has matured into a sophisticated, full-funnel advertising platform rivaling the capabilities of Google and Meta. The brands that thrive on Amazon in 2026 and beyond will be those that understand not just how to run campaigns, but why Amazon’s structural advantages create opportunities available nowhere else in digital advertising.

The Amazon Advertising Market

The scale and trajectory of Amazon’s advertising business tells a story of accelerating importance. Understanding where the market stands today—and where it’s heading—helps contextualize why mastering Amazon advertising has become essential for consumer brands across virtually every category.

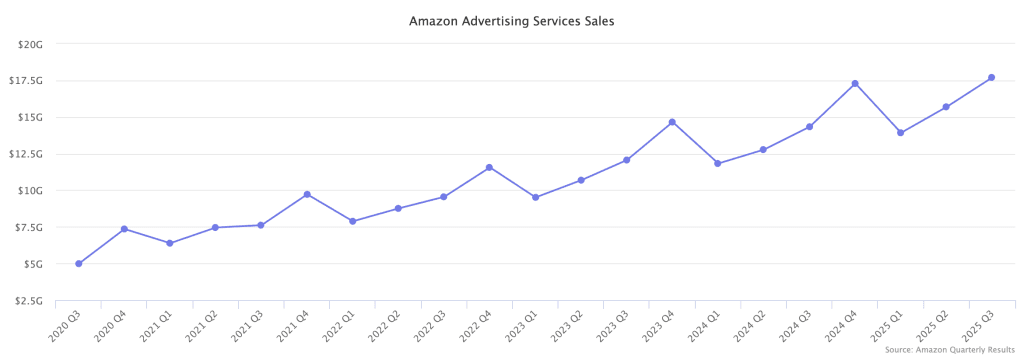

Amazon’s advertising business represents one of the fastest-growing segments in digital marketing, with Q3 2024 ad revenue reaching $14.3 billion—a 24% year-over-year increase. This growth stems from Amazon’s unique position: it controls both the advertising platform and the point of sale, creating a closed-loop ecosystem where every dollar spent can be directly attributed to purchases.

Three structural advantages make Amazon advertising distinctly powerful:

- First-party purchase data enables targeting precision impossible on other platforms. Amazon knows not just what customers browse but what they actually buy, when they repurchase, and how much they spend. This behavioral data—accumulated over decades and billions of transactions—powers targeting that reflects actual purchase intent rather than inferred interest.

- Bottom-funnel positioning means advertisers reach customers at the conversion point. A customer searching “wireless earbuds with noise cancellation” on Amazon has already moved past awareness and consideration—they’re ready to buy. This explains why Amazon’s average conversion rate of 9.96% dwarfs Google’s 2-4% average across industries.

- The organic-paid feedback loop creates compounding returns unique to Amazon. Advertising-driven sales directly improve organic search ranking through Amazon’s A10 algorithm, which heavily weights sales velocity. This means advertising investment builds long-term organic visibility—a dollar spent today continues generating returns through improved organic positioning tomorrow.

How Amazon’s Auction Works

Every click on an Amazon ad represents the outcome of a real-time auction happening in milliseconds. Understanding the mechanics of this auction—how Amazon decides which ads to show and how much advertisers pay—is fundamental to developing efficient bidding strategies that maximize return on ad spend. The auction mechanism differs meaningfully from what advertisers familiar with Google or Meta might expect. Amazon’s approach balances advertiser bids with relevance signals in ways that reward well-optimized listings and punish poorly-matched ads, regardless of bid level.

Amazon uses an enhanced second-price auction for Sponsored Products, the platform’s most popular ad type comprising 78% of total Amazon ad spend. In a second-price auction, the highest bidder wins the placement but pays only $0.01 more than the second-highest bid. If you bid $2.00 and the next highest bid is $1.50, you pay approximately $1.51 per click—not your full bid. This system encourages advertisers to bid their true maximum value without fear of overpaying.

However, the highest bid doesn’t always win. Amazon calculates Ad Rank using a formula that combines bid amount with relevance:

Ad Rank = Bid Amount × Relevance Score

This means a lower bid with higher relevance can outperform a higher bid with lower relevance. Amazon prioritizes customer experience, so products that shoppers actually want to buy receive preferential treatment. Relevance factors include historical click-through rate, conversion rate, listing quality, keyword relevance to the product, and recent sales velocity.

Unlike Google’s transparent Quality Score (1-10), Amazon provides no visible relevance metric. Instead, advertisers must infer relevance through performance data: improving click-through and conversion rates signals to Amazon’s algorithm that your product deserves better placement.

Core Metrics of Amazon Advertising

Amazon advertising has its own vocabulary, and fluency in these metrics is essential for effective campaign management. While some terms may sound familiar to advertisers from other platforms, their specific meanings and strategic implications on Amazon differ in important ways.

Mastering these metrics isn’t just about understanding definitions—it’s about knowing which metrics matter at which stage of your Amazon journey, and how to interpret the relationships between them to make better optimization decisions.

ACOS

ACoS (Advertising Cost of Sale) measures advertising efficiency at the campaign level:

ACoS = (Ad Spend ÷ Ad Revenue) × 100

An ACoS of 25% means you spend $0.25 in advertising for every $1.00 of ad-attributed sales. Lower ACoS indicates higher efficiency—but not necessarily better performance. Context matters: a new product launch might justify 50% ACoS to build velocity, while a mature product should target 15-20%.

TACOS

TACoS (Total Advertising Cost of Sale) measures advertising’s impact on your entire business:

TACoS = (Ad Spend ÷ Total Sales) × 100

TACoS includes both ad-attributed and organic sales in the denominator, revealing whether advertising builds sustainable business or merely rents customers. The strategic interpretation:

- Decreasing TACoS with increasing sales: Healthy growth—advertising fuels organic traction

- Increasing TACoS with flat sales: Ad dependency—organic momentum stalling

- Stable TACoS with growing revenue: Healthy scaling at consistent efficiency

Target benchmarks: 5-15% TACoS indicates balanced spending for established products; 20-25% TACoS is acceptable during aggressive growth phases.

Break-even ACOS

Break-even ACoS represents the maximum ACoS before advertising becomes unprofitable:

Break-even ACoS = (Product Margin ÷ Selling Price) × 100

If you sell a $50 product with $15 margin, your break-even ACoS is 30%. Anything below generates profit; anything above loses money on each sale. Knowing your break-even ACoS provides a clear guardrail for campaign optimization.

PART 2: AMAZON AD FORMATS – A COMPLETE TAXONOMY

Amazon offers a diverse portfolio of advertising formats, each designed to serve specific objectives at different stages of the customer journey. Selecting the right format—or combination of formats—for your goals is one of the most consequential decisions you’ll make in your Amazon advertising strategy.

This section provides a comprehensive overview of every advertising format available on Amazon, from the foundational Sponsored Products that should anchor most advertising strategies to the premium video and audio placements that extend reach across Amazon’s expanding media ecosystem. Understanding the strengths, requirements, and ideal use cases for each format enables you to build a full-funnel advertising approach tailored to your specific objectives.

Check out: Amazon’s Getting Started with Sponsored Ads Guide

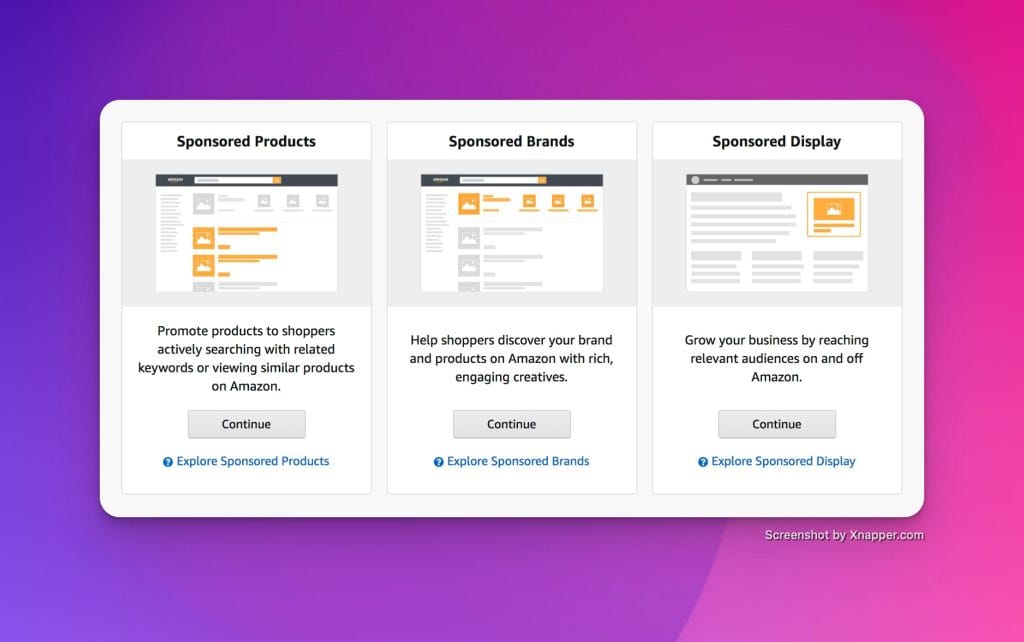

Sponsored Products

For most advertisers, Sponsored Products will represent the majority of Amazon ad spend—and for good reason. These ads deliver the most direct path from advertising investment to purchase, appearing exactly where customers are actively searching for products to buy. Sponsored Products should typically be your first advertising investment on Amazon, serving as both your primary conversion driver and your discovery engine for identifying which keywords and products deserve additional investment across other formats.

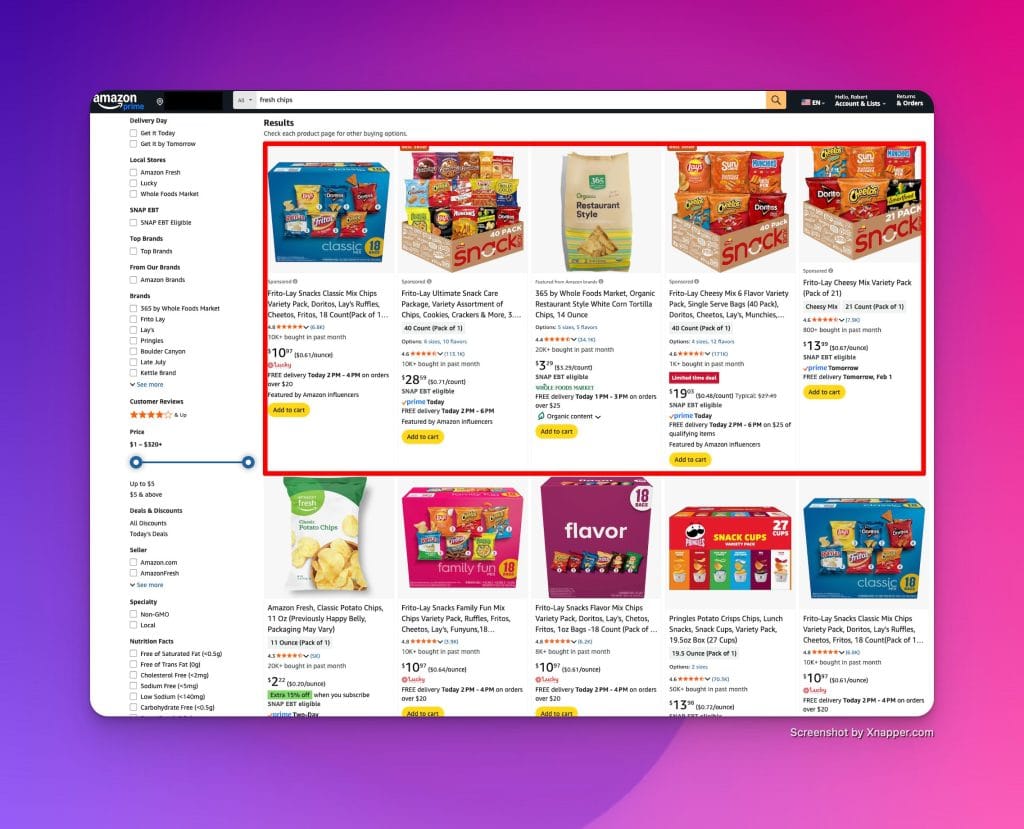

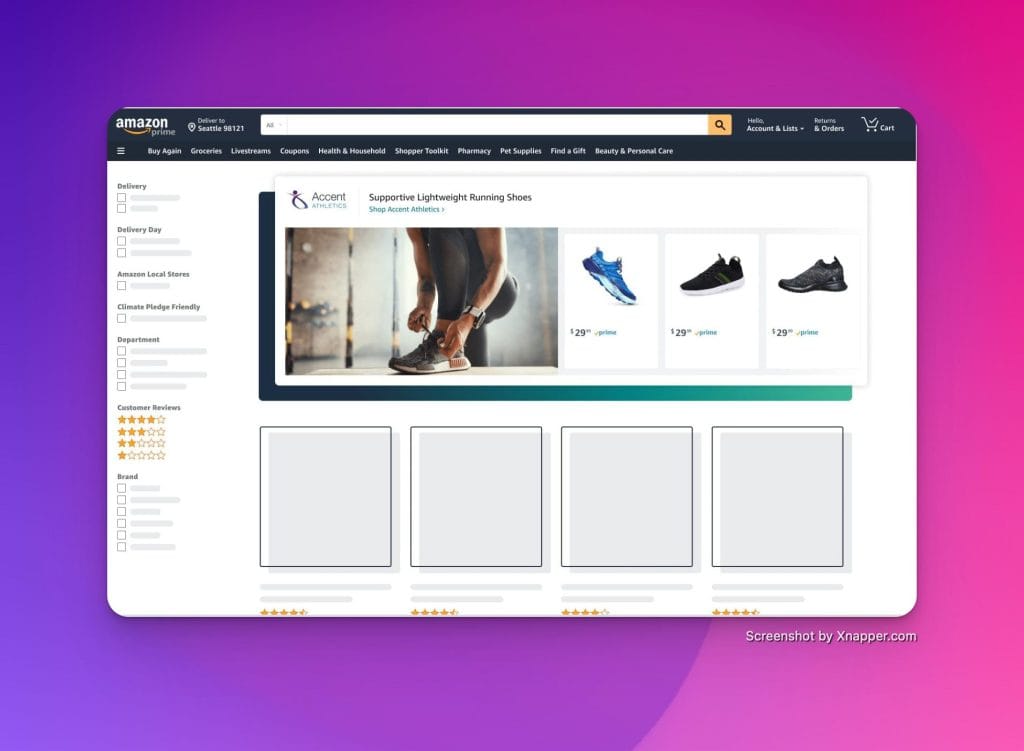

Sponsored Products are pay-per-click ads promoting individual product listings—the foundation of Amazon advertising representing 78% of total spend across the platform. These ads appear within search results and on product detail pages, marked subtly as “Sponsored” to blend with organic listings.

Placement Locations: top of search results (premium, highest-converting placement), throughout search results mixed with organic listings, on product detail pages of competitor or related products, and—since August 2023—on external sites including Pinterest, BuzzFeed, and Hearst publications.

Sponsored Product Targeting Modes

Automatic targeting lets Amazon’s algorithm match your ads to relevant searches based on product listing information. Amazon analyzes your title, description, and backend keywords, then displays ads to searches it deems relevant. Four distinct targeting groups exist: Close match (similar products), Loose match (related products), Substitutes (products customers might buy instead), and Complements (products frequently purchased alongside).

Manual targeting gives advertisers direct control over which searches or products trigger ads through keyword targeting (specific search terms with match type control) and product targeting (specific ASINs, brands, or categories).

Requirements: professional seller account (Brand Registry not required), Buy Box eligibility on advertised products, and minimum recommended budget of $10/day per campaign.

Sponsored Products Video

Video within Sponsored Products campaigns represents one of Amazon’s most significant recent innovations, bringing the engagement power of video to the high-intent environment of search results. For products that benefit from demonstration or visual differentiation, this format can dramatically improve performance. Video units within Sponsored Products campaigns may be clipped or reordered by Amazon based on shopper intent signals, allowing the algorithm to show the most relevant portions of your video content to each individual shopper.

Buying Model: CPC (within Sponsored Products)

Key Capability: you can upload up to five feature videos per ASIN in an ad group; up to three thumbnails may show. Moderation typically takes 48-72 hours.

Best For: higher CTR/engagement and faster feature comprehension for competitive SERPs where static images struggle to differentiate.

Check out: Amazon’s New Advertiser Getting Started with Sponsored Products Guide

Sponsored Brands

While Sponsored Products drive individual product sales, Sponsored Brands build broader brand awareness and showcase your product portfolio. These premium placements at the top of search results establish brand presence in ways that individual product ads cannot. Sponsored Brands require Brand Registry enrollment, which means they’re available only to brand owners—but this exclusivity also means less competition for these high-visibility placements compared to the more accessible Sponsored Products format.

Sponsored Brands appear prominently at the top of search results featuring your brand logo, custom headline, and multiple products. These ads drive brand awareness, introduce product portfolios, and direct traffic to Amazon Stores.

Sponsored Brands Three Formats

Product Collection showcases your brand logo, headline, and three or more products. As of January 2024, custom images are required for new Product Collection ads—specifications require minimum 1200 × 628 pixels.

Store Spotlight features up to three Store subpages with custom headlines and images, linking directly to your Amazon Store. Ideal for brands with distinct product lines or collections.

Video ads auto-play with muted audio when 50% visible in the viewport, appearing within search results and linking to product pages or Brand Stores.

Cost Model: CPC (cost-per-click) or vCPM (cost per 1,000 viewable impressions). CPCs typically exceed Sponsored Products due to premium placements.

Unique Metric: sponsored Brands exclusively track new-to-brand metrics, measuring first-time purchasers acquired through advertising—essential for growth-stage brands prioritizing customer acquisition.

Sponsored Brands Video

Video has become increasingly central to Amazon advertising success, and Sponsored Brands Video offers one of the most effective ways to differentiate your brand in crowded search results. The format combines the brand-building power of Sponsored Brands with the engagement advantages of video content. Performance data consistently shows that video ads capture attention and drive engagement at rates significantly exceeding static formats—making this investment worthwhile for brands with the creative assets to support it.

Sponsored Brands Video integrates video into search results, auto-playing muted when 50% visible. Performance data shows 2.5× higher CTR compared to standard Sponsored Products.

Specifications: 6-45 seconds duration (15-30 recommended), 1920×1080 or 1280×720 resolution, 16:9 aspect ratio, MP4/MOV format, maximum 500MB. Amazon’s Video Generator is now available in Sponsored Brands workflows in select locales.

Best For: fast education and differentiation; particularly strong for Beauty, Electronics, and product launches where visual demonstration drives understanding.

Sponsored Display

Sponsored Display extends your advertising reach beyond search results into the consideration and retargeting phases of the customer journey. This format enables you to stay present with shoppers who’ve shown interest in your products or category, whether they’re still on Amazon or browsing elsewhere across the web. The evolution of Sponsored Display from simple product targeting to sophisticated contextual and audience targeting has made it an increasingly important component of full-funnel Amazon advertising strategies.

Sponsored Display enables self-service display advertising reaching customers both on Amazon properties and across third-party websites and apps. Available to Brand Registry sellers and vendors.

Sponsored Display Targeting Mechanisms

Contextual targeting (formerly product targeting) places ads based on product or category relevance. Target specific products by ASIN to appear on their detail pages, or target entire categories refined by price range, ratings, Prime eligibility, or brand.

Audience targeting reaches customers based on shopping behaviors: Views remarketing (shoppers who viewed your or similar products in past 30 days), Purchases remarketing (past buyers for repeat purchase campaigns with 365-day lookback), Amazon Audiences (pre-built segments), and Custom audiences (built using Amazon Marketing Cloud data).

Placements: on Amazon (product detail pages, below Buy Box, shopping results, customer review pages) and off Amazon (third-party websites, apps, Twitch, IMDb).

Best For: retargeting previous visitors, competitor conquesting on rival detail pages, remarketing to past purchasers for replenishment products, and brand awareness through off-Amazon reach.

Check out: Amazon’s Display Ads Guide

Brand Stores: your Amazon Brand Storefront

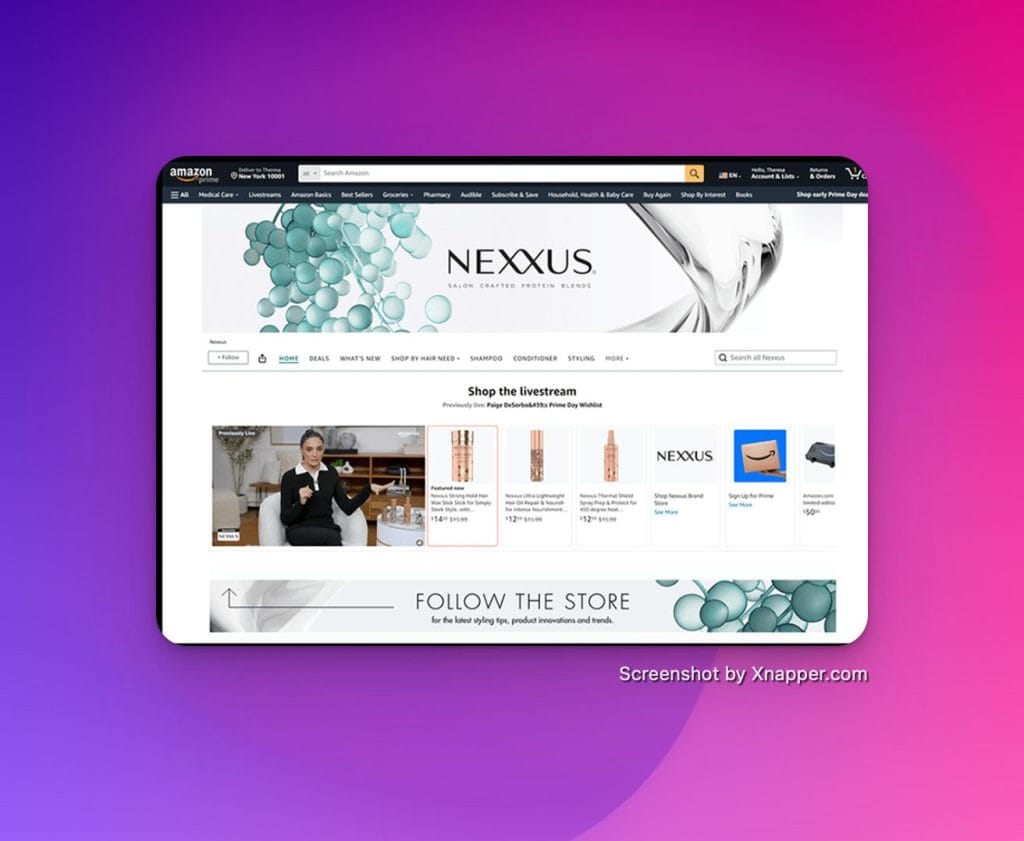

Amazon Brand Stores is a free self-service tool that allows sellers and vendors to design their own branded storefronts on Amazon, so old and new customers can experience their brand and navigate their products. These are highly flexible in terms of structure and content. To use Amazon Brand Stores, sellers and vendors need to be enrolled in Amazon Brand Registry. Above all, having an Amazon Brand Storefront supports your branding strategy.

Brand Stores represent a unique opportunity in Amazon advertising: a completely free way to create a branded shopping destination within Amazon’s ecosystem. While not a paid advertising format, Stores are essential infrastructure that makes your paid advertising more effective. A well-designed Brand Store serves as the ideal landing page for Sponsored Brands campaigns, enabling deeper product exploration and cross-selling that individual product detail pages cannot provide.

Brand Stores are free, customizable multi-page storefronts on Amazon across mobile, app, and desktop. Reachable via brand byline and direct Store URLs.

Cost: completely free (not a paid ad format).

Also, Amazon Posts provide Instagram-style content discovery at no cost—entirely free. Posts appear in brand feeds, on product detail pages, and in category-based feeds. Requires Brand Registry and an Amazon Store. Posts can be boosted into Sponsored Brands ads when organic performance demonstrates traction.

Requirements: Brand Registry enrollment. Provides Store Insights metrics including visits and sales within 14 days.

Strategic Value: higher conversion from curated discovery and cross-sell. Stores can be promoted through Sponsored Brands Store Spotlight format, and Amazon Posts can drive organic traffic to Store pages.

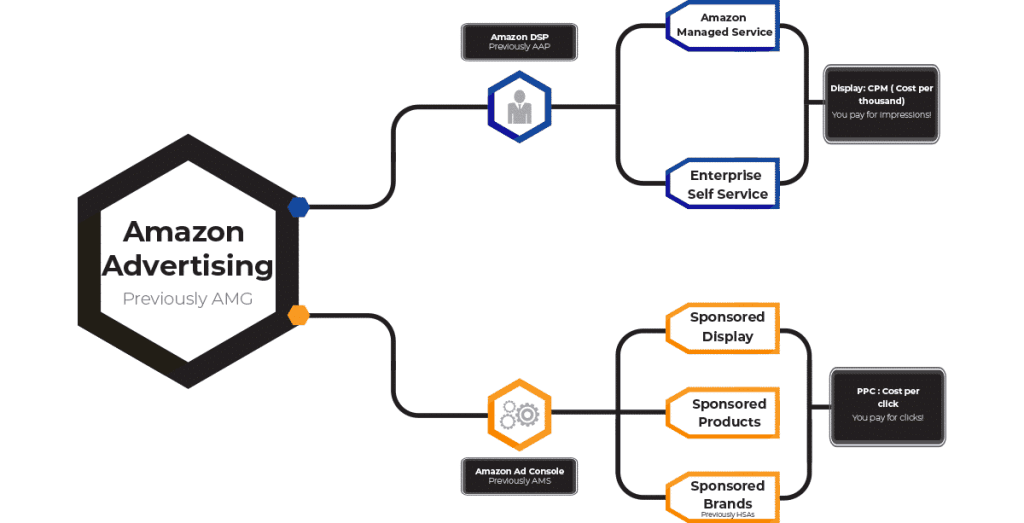

Amazon DSP (Demand-Side Platform)

Amazon Sellers looking for high-quality display advertising and video commercials ads can use Amazon’s Demand Side Platform (DSP) – a service that allows you to buy video and display advertising across Amazon internet and partnered properties. Amazon DSP provides two distinct features, first, it’s an automated programmatic ad buying platform across hundreds of websites, and two, it allows for advanced targeting possibilities based on Amazon’s own purchase data.

Amazon DSP opens the door to programmatic advertising at scale, enabling reach across Amazon’s owned properties and the broader web. This format serves a fundamentally different purpose than sponsored ads—building awareness and consideration among audiences who may not yet be actively searching for your products. DSP also provides capabilities unavailable through sponsored ads, including frequency capping, sequential messaging, and access to premium video inventory across streaming platforms.

Amazon DSP enables programmatic buying of display, video, and audio ads both on and off Amazon. Unlike sponsored ads that operate on CPC models, DSP uses CPM (cost per thousand impressions) pricing.

Critical Distinction: DSP reaches audiences regardless of whether the advertiser sells on Amazon—enabling non-endemic advertisers (services, B2B) to leverage Amazon’s audience data for off-Amazon campaigns.

Amazon DSP Access Models

Self-service DSP provides full campaign control without management fees but typically requires $100K+ monthly spend or agency partnership. Third-party platforms like Perpetua, Pacvue, and Trellis offer access with lower minimums starting around $5,000.

Managed-service DSP includes Amazon’s team managing campaigns on your behalf. Minimum investment: $50,000 (varies by country). Includes consulting, strategy development, and ongoing optimization.

Audience Capabilities: in-market segments, lifestyle segments, life events, demographics, lookalike audiences, remarketing audiences, and custom audiences built through Amazon Marketing Cloud.

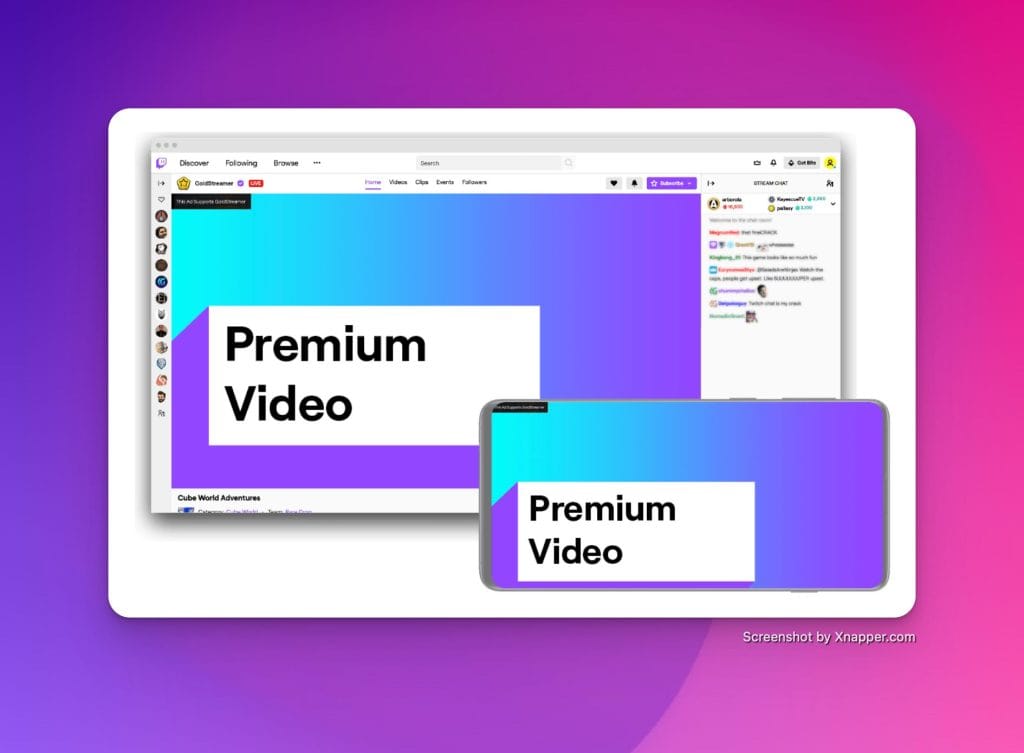

Inventory: Amazon-owned properties (Prime Video, Amazon Freevee, Fire TV, Twitch, IMDb, Amazon Music, Fire Tablet, Alexa devices) plus third-party publishers through Amazon Publisher Direct.

Streaming TV and Video Ads

The explosion of streaming video consumption has created massive new advertising opportunities, and Amazon sits at the center of this shift through Prime Video, Twitch, and Fire TV. Streaming TV ads bring the impact of television advertising to digital with the targeting precision and measurement capabilities that traditional TV lacks. With Prime Video’s ad-supported tier now reaching over 315 million monthly viewers globally, streaming TV has become a core component of full-funnel Amazon advertising strategies for brands seeking upper-funnel reach.

Streaming TV ads appear as full-screen, non-skippable content across Prime Video (including the ad-supported tier launched in 2024), Amazon Freevee, Twitch, Fire TV Channels, Thursday Night Football, and 100+ streaming apps through Amazon Publisher Direct.

Specifications: 15 or 30-second standard duration, MP4 format, full-screen non-skippable delivery. Interactive elements support add-to-cart and learn-more actions via remote or QR code.

Performance Metrics: 175M+ average monthly U.S. ad-supported streaming reach, 77% of ad-exposed viewers purchase on Amazon, 125% incremental reach when adding Fire TV Feature Rotator placements.

Cost Structures: Streaming TV through Sponsored Ads console uses CPM pricing with no minimum; DSP self-service recommends $10K minimum; managed-service requires $50K minimum.

Audio Ads

Audio advertising captures attention in moments when visual ads cannot reach consumers—during commutes, workouts, cooking, and countless other “screenless” activities. Amazon’s audio inventory across Amazon Music and partner publishers provides access to these valuable listening moments. The addition of interactive voice capabilities through Alexa integration makes Amazon’s audio ads uniquely actionable, enabling listeners to respond to ads with simple voice commands.

Amazon Audio Ads reach listeners through non-skippable 10-30 second spots on Amazon Music’s free tier, Twitch, and partner publishers. Companion banners (1024×1024 pixels) appear alongside audio.

Interactive Capability: Interactive audio ads enable Alexa responses—”Alexa, add to cart” drives 1.5× higher purchase intent. Amazon launched an “Audio generator” (generative AI) to quickly build interactive audio ads.

Access: Requires Amazon DSP; managed service typically requires ~$15,000/month minimum.

Best For: Incremental reach in “screenless” moments, brand awareness among streaming audio audiences.

Additional Formats: Twitch and Amazon Live

Beyond the core advertising formats, Amazon offers specialized placements across its growing ecosystem of media properties. These formats serve specific audiences and use cases that may align with particular brand objectives or target demographics. Understanding these additional options helps you identify opportunities to reach audiences in contexts where your competitors may not yet be present.

Twitch Ads reach 35M average daily users, approximately 70% aged 18-34. Format options include premium video (pre-roll and mid-roll), First Impression Takeover (first ad viewers see daily), display ads, and creator sponsorships. SureStream delivery technology bypasses ad blockers.

Amazon Live enables shoppable livestreaming with real-time product demonstrations, chat, and integrated purchase links. Options include self-service through Amazon Live Creator app (free), sponsored influencer streams, and Amazon-produced managed content (~$50,000 minimum). Performance data shows 2.5× higher purchase rate for viewers engaging with Live content.

PART 3: TARGETING STRATEGIES AND KEYWORD MANAGEMENT

Targeting is where strategy meets execution in Amazon advertising. The decisions you make about which searches, products, and audiences to target—and which to exclude—determine whether your advertising investment generates profitable returns or disappears into wasted spend.

This section covers the full spectrum of targeting options available on Amazon, from the automatic discovery that helps you learn what works to the precise manual targeting that maximizes efficiency on proven opportunities. Mastering these targeting strategies is essential for building campaigns that scale profitably.

Automatic Targeting: The Discovery Engine

Every successful Amazon advertising account needs a discovery mechanism—a systematic way to identify new keywords, products, and audience segments that convert. Automatic targeting serves this essential function, using Amazon’s algorithms to test your products against relevant searches at scale.

While automatic campaigns rarely achieve the efficiency of well-optimized manual campaigns, their value lies in the intelligence they generate. The insights harvested from automatic campaigns fuel the expansion of your manual targeting, creating a continuous improvement loop.

Amazon’s algorithm analyzes your listing and matches ads to relevant searches—a process impossible to replicate manually at scale. The four targeting groups serve distinct purposes:

- Close Match: Similar products to yours—typically highest relevance and conversion

- Loose Match: Related products—broader reach with varying relevance

- Substitutes: Products customers might buy instead—competitive positioning

- Complements: Products frequently purchased alongside—cross-sell opportunities

Best Practice: set individual bids for each targeting group rather than using a single default bid. Close match and substitutes typically convert at higher rates, justifying differentiated bid levels. Run automatic campaigns for 7-14 days minimum before harvesting data.

Manual Keyword Targeting

Manual keyword targeting puts you in direct control of which searches trigger your ads. This precision enables you to concentrate spend on the specific terms that drive profitable conversions while avoiding the waste inherent in broader automatic targeting.

Understanding match types is fundamental to effective manual targeting. Each match type serves a different purpose in your campaign architecture, and using them strategically creates a system that balances discovery with efficiency.

The match type hierarchy determines both reach and relevance:

- Broad Match casts the widest net, capturing synonyms, related terms, and variations. “Wireless earbuds” might match “bluetooth headphones,” “cordless ear pods,” or “earbuds without wires.” Best for discovery and awareness, but requires diligent negative keyword management.

- Phrase Match balances reach and control. The exact phrase must appear in the search query in order, though prefix and suffix words are permitted. “Cotton sheet set” matches “king cotton sheet set blue” but not “cotton fitted sheet set.”

- Exact Match maximizes relevance and typically delivers highest conversion rates. The search must precisely match your keyword (Amazon permits plurals and minor variations). “Cotton sheet set” only matches that specific phrase.

Bid Hierarchy Recommendation: exact match receives highest bids (most valuable, qualified traffic), phrase match receives medium bids, and broad match receives lowest bids. This structure concentrates spend on proven terms while maintaining discovery capability.

Product and Category Targeting

Not all valuable advertising opportunities can be captured through keyword targeting. Product and category targeting enables you to reach shoppers based on the specific products they’re viewing or the categories they’re browsing—regardless of the search terms they used to get there.

This targeting approach is particularly valuable for competitive conquesting (appearing on competitor product pages), complementary product strategies, and categories where search behavior is highly variable or difficult to predict.

ASIN Targeting positions your ad on specific product detail pages. Strategic use cases include:

- Competitor conquesting: Appear on rivals’ listings to capture comparison shoppers

- Complementary products: Appear on items frequently purchased alongside yours

- Defensive positioning: Target your own ASINs to prevent competitor ads

Category Targeting reaches browsers within entire product categories. Refinement options include price range, star rating, Prime eligibility, and brand—enabling precision like “target all products in ‘Fitness Trackers’ category priced $50-$100 with 4+ stars, excluding [Brand X].”

Strategic Note: Product targeting typically shows higher ACoS than keyword targeting—customers viewing competitor pages have established intent toward that competitor. However, it builds valuable brand awareness and can shift market share over time.

Negative Targeting: Preventing Waste

Negative targeting is the often-overlooked counterpart to positive targeting—equally important for campaign efficiency but frequently neglected. Every irrelevant click prevented by a negative keyword is budget preserved for a relevant one.

Developing a systematic approach to negative keyword management separates efficient advertisers from those who watch budget leak away on searches that will never convert.

Negative keywords and products eliminate irrelevant traffic that consumes budget without converting.

Amazon’s Official Rule: Before negating a keyword, evaluate performance after it has received at least 20 clicks to avoid overreacting to noise.

Match Type Behavior: Negative exact blocks only the specific phrase (including plurals and close variants); negative phrase blocks any search containing that phrase sequence.

Systematic Process:

- Download Search Term Reports weekly (minimum)

- Filter for high clicks with zero sales (threshold: 15-20+ clicks)

- Identify high-ACoS terms significantly above target

- Evaluate low-CTR terms indicating poor relevance

- Add non-performing terms as negatives at appropriate level

Common Negative Categories: Irrelevant product types, wrong sizes/colors/variants, “cheap,” “free,” or “used” (if selling premium/new), competitor brand names (unless intentionally conquesting), non-converting long-tail variations.

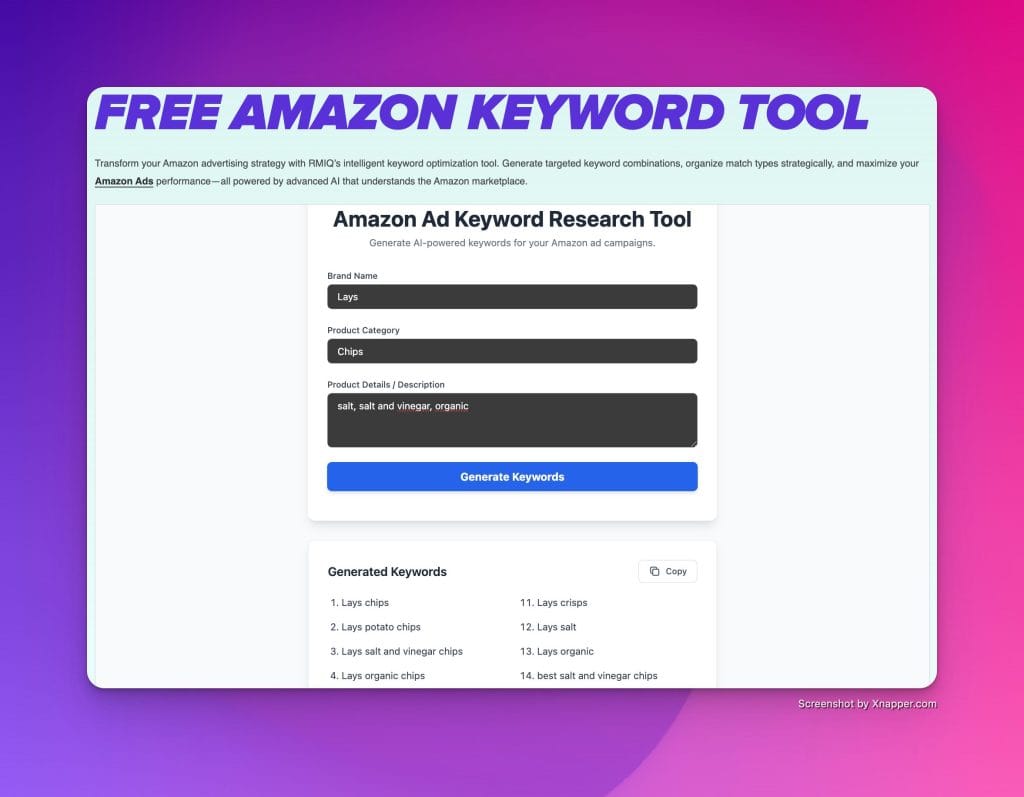

Amazon Keyword Research

Keyword research on Amazon differs fundamentally from keyword research on Google or other search engines. Amazon searchers have already decided to buy something—they’re looking for the right product, not information. This purchase intent shapes which keywords matter and how to prioritize them.

Building a robust keyword research system requires combining multiple data sources, each offering different insights into how customers search for products in your category. Amazon keyword research differs from Google SEO/SEM, because Amazon search queries are closer to purchase intent and mapped to product catalog attributes and retail context. This is epic for consumer brands and sellers.

Primary Amazon-Native Data Sources:

- Sponsored Products Auto Targeting – Amazon recommends new advertisers begin with auto targeting and let it run about two weeks before creating manual campaigns. The four auto targeting strategies provide insights into different types of search behavior.

- Search Term Reports – Use reports from auto campaigns, as well as “suggested” product and category targets surfaced in campaign creation, to seed product and category targeting strategies.

- Brand Analytics (Brand Registry) – Search Query Performance dashboards include search query volume plus funnel metrics like impressions, clicks, cart adds, and purchases.

Try out RMIQ’s Amazon Keyword Research Tool at no cost and no risk.

Keyword Workflow That Scales

Having the right keywords is only half the battle—organizing them into a system that enables continuous improvement is equally important. This workflow provides a repeatable process that can be templated across categories and markets.

The key principle is progression: keywords earn their way from discovery into increasingly precise (and higher-bid) targeting as they prove performance.

Step A: Build a Keyword Map – Group keywords by: branded, category generic, attribute/benefit, problem/solution, competitor, and use-case. Amazon recommends adding relevant search terms covering features, materials, size, and use.

Step B: Run Discovery with Guardrails – Use Sponsored Products auto and broad/phrase to discover, but protect budget via negatives and conservative placement multipliers until conversion is proven.

Step C: Promote Winners – Move converting queries into exact-match manual campaigns; bid higher for exact than phrase than broad (Amazon explicitly recommends this bid hierarchy).

Step D: Expand Beyond Keywords – When language is ambiguous, translations are risky, or the category is heavily comparison-driven, use product and category targeting.

PART 4: CAMPAIGN STRUCTURE AND ORGANIZATION

Campaign structure is the architecture that either enables or constrains your ability to optimize. A well-organized account makes it easy to identify what’s working, isolate problems, and scale successes. A poorly structured account creates confusion, wastes spend through cannibalization, and limits your ability to make data-driven decisions.

This section provides a blueprint for organizing your Amazon advertising campaigns in a way that supports both day-to-day optimization and long-term scaling. The principles here apply whether you’re managing a handful of products or thousands of SKUs.

Account Hierarchy

Amazon advertising is organized in a four-level hierarchy: Portfolios, Campaigns, Ad Groups, and Keywords/Targets. Understanding how to use each level effectively is essential for maintaining control as your advertising program grows.

The hierarchy you establish early will either support or constrain your ability to optimize. Investing time in proper structure from the beginning pays dividends as complexity increases.

Portfolios group related campaigns for aggregate budgeting and reporting. Organize portfolios by brand, product line, category, or strategic objective. Portfolio-level budgets prevent overspend while enabling flexible allocation across constituent campaigns.

Campaigns represent the primary organizational unit containing ad groups. Best practice: create separate campaigns for each targeting type (Auto, Manual Keyword, Manual Product) and for each strategic objective (Brand Defense, Category Growth, Conquest).

Ad Groups segment products and targeting within campaigns. Key principle: limit each ad group to products that logically share targeting and can be optimized together. For maximum control, use single-ASIN ad groups—this enables precise bid optimization per product but increases management overhead.

Keywords/Targets represent individual targeting elements with specific bids. Amazon recommends limiting ad groups to 50 keywords maximum for optimal performance.

Canonical Campaign Architecture

A practical, scalable account structure is less about finding “one perfect campaign” and more about separating intents so optimizations don’t fight each other. Amazon’s own targeting guide warns against mixing targeting strategies in the same ad group when you want clean measurement.

The architecture below has proven effective across thousands of accounts because it maps cleanly to automation, reporting, and the natural progression of keywords from discovery to profit.

Foundation Layer (Always-On):

- Sponsored Products — Auto targeting, split by the four auto groups (Close/Loose/Substitutes/Complements) with separate bids per group for control

- Sponsored Products — Manual keyword, segmented by match type in separate ad groups or campaigns to keep bids and search-term harvesting clean

- Sponsored Brands — Branded (defense) campaigns landing on Stores, plus non-branded category expansion campaigns

Growth Layer (Selective Scaling):

- Sponsored Products — Manual product/category targeting for conquesting competitor PDPs and controlling adjacency

- Display ads — Contextual + remarketing

- Amazon DSP / Streaming TV / Audio — Full-funnel reach and frequency control when measurement and incrementality questions are clear

Budget Allocation Framework

How you distribute budget across campaigns and formats shapes the outcomes you’ll achieve. Allocating too heavily toward discovery wastes money on learning; allocating too heavily toward proven winners leaves growth opportunities undiscovered. The framework below provides starting guidance, but optimal allocation varies by business stage, competitive dynamics, and strategic objectives. Treat these as starting points to refine based on your specific performance data.

Amazon’s new advertiser guide states that “just $10 a day can help you get clicks and sales,” recommending campaigns with no end date for steady traffic.

Recommended Starting Allocation:

- Sponsored Products – Exact Match: 40%

- Sponsored Products – Broad/Phrase: 20%

- Sponsored Products – Auto: 15%

- Sponsored Brands: 15%

- Sponsored Display: 10%

Key Principle: Keep conversion capture (Sponsored Products) always funded, then layer upper/mid-funnel formats once PDP conversion and supply constraints are stable.

Event-Driven Scaling: Use Amazon’s budget rules and bidding rules so event prep doesn’t require manual hourly changes. This includes schedule-based budget rules and performance-based budget rules (e.g., increasing budget when ROAS hits a threshold).

Search-Term Harvesting Workflow

Harvesting is the systematic process of migrating keywords from discovery campaigns to precision campaigns. This workflow turns the intelligence generated by automatic and broad-match campaigns into the exact-match profit drivers that scale your business.

Consistency is key: harvesting should happen on a regular schedule, using defined thresholds that balance acting on sufficient data against waiting too long to capture opportunities.

Step 1: Run Sponsored Products Auto + Broad/Phrase discovery to generate query data (Amazon recommends starting with auto for new advertisers)

Step 2: Promote converting queries into Exact (“profit lane”) and Phrase (“scale lane”) ad groups with higher bids and tighter negatives

Step 3: Add negatives to discovery campaigns to prevent cannibalization and reduce waste, using the 20-click minimum as a default threshold

Decision Thresholds:

- 20+ clicks with 3+ orders → Move to manual exact

- 20+ clicks with 0 orders → Add as negative

- ACoS significantly below target → Increase bid and promote

- High impressions, low CTR → Review listing relevance or negate

PART 5: BIDDING STRATEGIES AND OPTIMIZATION

Bidding is where your advertising strategy translates into actual market outcomes. The bids you set—and the bidding strategies you employ—determine which placements you win, how much you pay for them, and ultimately whether your campaigns generate profit or loss.

Amazon provides multiple bidding tools that, when used strategically, can significantly improve campaign performance. This section explains how each bidding mechanism works and provides practical guidance for applying them effectively.

Dynamic Bidding Strategies

Amazon’s dynamic bidding automatically adjusts your bids based on the likelihood of conversion. Understanding how each strategy works—and when to use it—enables you to match your bidding approach to your campaign objectives and risk tolerance.

The choice of bidding strategy has significant implications for both spend velocity and efficiency. More aggressive strategies can accelerate results but also increase risk; conservative strategies protect against waste but may limit opportunity capture.

Dynamic Bids – Down Only (default, recommended for beginners): Amazon reduces your bid by up to 100% when conversion appears unlikely. This conservative approach minimizes wasted spend on low-probability clicks.

- Best for: Budget-conscious sellers, initial testing phases, profitability-focused campaigns, risk-averse advertisers.

Dynamic Bids – Up and Down (aggressive): Amazon increases bids up to 100% for top-of-search placements and up to 50% for other placements when conversion appears likely. Bids decrease up to 100% when conversion appears unlikely.

- Best for: Proven products with strong conversion history, scaling campaigns, competitive categories where top placement drives disproportionate results.

Critical Warning: “Up and Down” can double your stated bid. Ensure budget and margins accommodate potential CPC doubling.

Fixed Bids maintain constant bid regardless of conversion probability. This provides predictable spend but requires comprehensive market understanding.

- Best for: Brand defense campaigns (visibility regardless of immediate conversion), experienced advertisers with strong performance data, predictable budgeting requirements.

Placement Adjustments

Not all ad placements are created equal. Top-of-search positions typically deliver the highest conversion rates, while other placements may convert at lower rates but provide valuable visibility. Placement adjustments let you bid differently for different positions based on their value to your business. Amazon’s placement controls have expanded significantly, giving advertisers more granular control over where their budgets are deployed within search results and product pages.

Amazon allows bid increases of up to 900% for specific placements:

Top of Search (First Page): Premium placement driving highest conversion rates—can deliver 3× higher CTR than other positions.

Rest of Search: Amazon expanded Sponsored Products placement controls to include “rest of search” bid adjustments, similar to other placement controls.

Product Pages: Ads appearing on detail pages. Valuable for conquesting campaigns or complementary product strategies.

Practical Recommendation: Default placement modifiers to 0% during initial learning, then selectively increase modifiers for placements that demonstrate profitable conversion rate and ACoS performance using placement reports.

Strategic Combination: Layering placement adjustments with dynamic bidding creates compounded effects. Example: $1.00 base bid + 100% TOS adjustment + “Up and Down” bidding = potential $4.00 CPC at top of search during high-conversion moments.

Optimization Workflow

Optimization isn’t a one-time event—it’s an ongoing discipline. The advertisers who achieve sustained success on Amazon are those who establish regular optimization routines and execute them consistently week after week.

This workflow provides a practical framework for regular campaign maintenance, ensuring that you continuously improve performance while preventing small problems from becoming large ones.

Weekly Optimization Cadence:

- Download Search Term Reports

- Identify winners (move to exact match, increase bids)

- Identify losers (add as negatives)

- Review ACoS by campaign and ad group

- Adjust bids based on performance versus targets

- Check inventory levels and Buy Box status

- Verify high-performing campaigns aren’t budget-capped

- Document all changes for trend analysis

Decision Thresholds:

- Keyword with 15+ clicks, 0 orders → Reduce bid or negate

- Keyword with ACoS 20%+ above target → Reduce bid 15-20%

- Keyword with ACoS 20%+ below target → Increase bid 15-20%

- Campaign consistently hitting budget cap with good ACoS → Increase budget

- Campaign 60+ days without improvement → Consider pausing

Check out: Learning Amazon’s Advertising Console

PART 6: MEASUREMENT, ATTRIBUTION, AND ANALYTICS

Measurement is the foundation of strategic decision-making in Amazon advertising. Without accurate attribution and meaningful analytics, you’re optimizing blind—making changes without understanding their true impact on your business. Amazon provides increasingly sophisticated measurement tools, from basic campaign metrics to advanced clean room analytics. This section explains what’s available, how to use it, and how Amazon’s measurement approach compares to other platforms you may be familiar with.

Cross-Platform Metrics Comparison of Amazon, Google, Meta

If you’re coming to Amazon from Google, Meta, or other advertising platforms, understanding how metrics translate—and where they don’t—is essential for setting realistic expectations and avoiding costly misinterpretations. The key difference vs Google and Meta? Amazon’s closer to the purchase decision – this is amazing for consumer brands and sellers.

The table below highlights key differences in how the major platforms measure advertising performance, with particular attention to attribution windows and metric definitions that differ across platforms.

Cross-Platform Metrics: Amazon Ads vs Google Ads vs Meta Ads

| Metric | Amazon Ads | Google Ads | Meta Ads |

| ROAS | Evaluated at ASIN and brand levels; tied to ad-attributed sales + NTB and halo effects | Target ROAS bidding uses conversion actions; default 30-day window | Default 7-day click + 1-day view; sensitive to attribution settings |

| ACoS | Amazon-native metric; ad spend as % of attributed sales; inverse of ROAS | Not standard; Google uses ROAS/CPA/ROI frameworks | Not standard; Meta emphasizes ROAS, CPA, cost-per-result |

| Conversion Window | 7-day for Sponsored Products; 14-day for Sponsored Brands/Display | Configurable; defaults to 30 days click-through, 1 day view-through | 7-day and 28-day view windows being removed Jan 2026 in API |

| CTR | Strong proxy for ad relevance and listing alignment | Affects Quality Score and auction outcomes | Creative resonance proxy; engagement behavior varies |

Amazon Attribution

Amazon Attribution solves a critical measurement gap: understanding how your marketing efforts outside of Amazon—social media, search ads, email campaigns, influencer partnerships—drive sales on Amazon. Without this visibility, you’re missing a significant piece of the customer journey. For brands investing in omnichannel marketing, Amazon Attribution provides the data needed to understand which external channels deserve continued investment based on their Amazon sales impact.

Amazon Attribution is a free measurement solution tracking how non-Amazon marketing (search, social, display, email, influencer campaigns) drives Amazon sales. Unique tracking tags enable 14-day attribution windows.

How It Works: Unique tracking tags (URL parameters) append to destination URLs. When customers click through and purchase on Amazon within 14 days, Attribution credits the originating campaign.

Brand Referral Bonus: Enrolled brands earn an average 10% bonus on product sales driven through Attribution-tracked external marketing. Processing time is approximately two months between sale and bonus receipt.

Integration Capabilities: Extends to Google Ads (keyword file URL suffixes), Meta (bulk template export), email platforms, influencer campaigns, and third-party tools through API access.

Amazon Marketing Cloud (AMC)

Amazon Marketing Cloud represents Amazon’s most sophisticated analytics capability—a privacy-preserving clean room that enables analysis impossible through standard reporting. For advertisers ready to invest in advanced analytics, AMC unlocks insights that can fundamentally change how you understand customer behavior. While AMC requires more technical sophistication than standard reporting tools, the analytical power it provides justifies the investment for brands serious about optimizing their Amazon advertising at scale.

AMC is a secure, privacy-preserving “clean room” providing analytical capabilities impossible through standard reporting. Available at no additional cost to eligible advertisers.

Core Capabilities:

- Connects data across Sponsored Ads, DSP, Streaming TV, and first-party uploads

- Provides customer journey analysis spanning 25+ months of historical data

- Enables custom audience creation and activation

- Maintains privacy through aggregation thresholds (minimum 100 users per query)

SQL-Based Analytics: AMC requires SQL knowledge for custom analysis—no pre-built dashboards exist for advanced use cases. Most teams require 2-3 weeks to develop basic AMC SQL proficiency.

2025-2026 Evolution: AMC now directly accessible through Amazon Ads Console. No-code templates and AI assistance through “Ads Agent” enable users without SQL expertise to run basic queries. Amazon also expanded AMC measurement with a five-year retail lookback for purchase signals.

New-to-Brand and Long-Term Sales Metrics

Traditional advertising metrics focus on immediate conversion—did this ad lead to a sale? But the most valuable advertising often creates customers who purchase repeatedly over time. Amazon’s newer metrics help capture this longer-term value creation. Understanding new-to-brand acquisition and long-term sales impact enables you to make better investment decisions, particularly when evaluating upper-funnel advertising that may not show immediate returns.

New-to-Brand (NTB): Amazon defines shoppers as “new to brand” when they have not converted with a brand in the last 12 months. NTB metrics are central to measuring whether upper-funnel investment brings incremental shoppers versus harvesting existing demand.

Long-Term Sales (LTS) and LTS ROAS: Launched at unBoxed 2024, these metrics estimate incremental sales value over the next 12 months based on how campaigns move NTB shoppers through the funnel (detail page views, branded searches, add-to-cart, purchases).

PART 7: ADVANCED STRATEGIES FOR EXPERIENCED ADVERTISERS

Once you’ve mastered the fundamentals of Amazon advertising, a range of advanced strategies becomes available to further optimize performance. These techniques require solid foundational knowledge to execute effectively, but they can unlock significant performance improvements for advertisers ready to implement them.

This section covers strategies that go beyond basic campaign management—from A/B testing and dayparting to brand defense and conquest campaigns. Each technique builds on the fundamentals covered earlier and provides additional levers for driving profitable growth.

A/B Testing and Conversion Optimization

Your product detail page is where advertising investment either converts or is wasted. No amount of bid optimization can compensate for a poorly converting listing. A/B testing provides the method to systematically improve conversion rates over time. Amazon’s built-in experimentation tools make it possible to test listing changes with statistical rigor, removing the guesswork from optimization decisions.

On Amazon, ad efficiency is constrained by your product detail page conversion. Amazon provides “Manage Your Experiments,” a Seller Central tool enabling A/B tests on titles, images, bullet points, descriptions, and A+ Content with randomized traffic splits and statistical significance reporting.

Eligibility: Requires a professional seller account and a role on a Brand Registry-enrolled brand.

- Key Insight: The best bid cannot rescue a weak PDP. Present “CRO tasks” and “ad tasks” together when optimizing for profitable growth.

Dayparting

Not all hours of the day—or days of the week—deliver equal advertising value. Dayparting allows you to concentrate spend during high-conversion periods and reduce waste during times when shoppers browse but don’t buy. This strategy is particularly valuable when budgets are constrained, enabling you to maximize impact from limited daily spend by focusing on proven high-performance windows.

Dayparting schedules ads during specific hours based on conversion patterns. Amazon hourly data reveals conversion rates can swing 200-300% between peak and off-peak hours.

When Dayparting Makes Sense:

- Limited budgets frequently cap out before day ends

- Clear patterns in hourly/daily performance data

- High CPC variability throughout day (avoid “CPC bid rush” at midnight PST budget reset)

Implementation: Amazon offers schedule-based budget rules and performance-based budget rules. During tentpole events (Prime Day, Black Friday), disable dayparting to capture 24/7 demand.

- Best Practice: Analyze 5-20 days of hourly data before setting schedules. Common peak hours: 6pm-12am; common low periods: 12am-5am. Revisit schedules monthly as patterns evolve seasonally.

Brand Defense

Your brand keywords represent some of your most valuable digital real estate—searches from customers who already know and want your products. Failing to defend these terms means ceding this high-intent traffic to competitors. Brand defense isn’t just about blocking competitors; it’s about maximizing conversion from your most valuable traffic and controlling the narrative around your brand on Amazon.

Research shows 30% of branded searches in Health & Personal Care result in purchasing a different brand. Competitors actively bid on your brand terms to intercept customers seeking you specifically.

Defense Tactics:

- Sponsored Products: Exact match on branded keywords plus common misspellings

- Sponsored Brands: Headline ads at top of branded search results linking to Brand Store

- Product targeting: Self-target your own ASINs to fill “related products” carousels with your products

- A+ Content comparison charts: Free defense showcasing your product lineup against competitors

When to Reduce Defense: you dominate top 3 organic positions, low competitor pressure on branded terms (monitor regularly), or high CPCs with declining ROAS indicate over-defending.

Conquest Campaigns

While brand defense protects your existing customers, conquest campaigns seek to capture customers from competitors. This offensive strategy requires realistic expectations—you’re fighting against established purchase intent—but can effectively build brand awareness and shift market share over time. Conquest works best when your product offers clear advantages over the competitor being targeted, giving comparison shoppers a compelling reason to switch.

Implementation:

- Create separate manual campaigns targeting competitor brand names as keywords

- Use product targeting to appear on competitor product detail pages

- Prioritize targeting ASINs with lower reviews or ratings than your products

Realistic Expectations:

- Higher ACoS than category campaigns (customers have competitor intent)

- Lower conversion rates initially (intent mismatch)

- Goal: Build brand awareness and eventually rank organically for competitor terms

Budget and Bid Rules Automation

Manual campaign adjustments work at small scale, but become impractical as your advertising program grows. Amazon’s rules-based automation provides a middle ground between full manual control and algorithmic automation—allowing you to define the logic while the system handles execution.

Effective use of rules automation is particularly important during high-stakes periods like Prime Day and Black Friday, when manual adjustments simply cannot keep pace with market dynamics.

Amazon documents schedule-based budget rules and performance-based budget rules for tentpole events:

• Increase budget when ROAS hits a threshold

• Schedule bid rules for Prime Day and Halloween

• Event-driven scaling without manual hourly changes

- RMIQ’s Tip: treat Amazon-native rules as the baseline automation layer, and let higher-level AI optimization sit above them. This reduces “automation conflict” where two systems fight over the same lever.

PART 8: PREREQUISITES – RETAIL READINESS BEFORE ADVERTISING

Advertising cannot fix fundamental product or listing problems. Before investing significant budget in Amazon advertising, you must ensure that your products are “retail ready”—meeting the baseline requirements that enable advertising to convert effectively.

This section covers the prerequisites that must be in place before your advertising investment can generate profitable returns. Skipping these steps is the most common mistake new Amazon advertisers make, resulting in wasted spend and disappointed expectations.

Featured Offer Eligibility Gate

The Featured Offer (formerly known as the Buy Box) is the “Add to Cart” button that most Amazon customers use to purchase. If you don’t have the Featured Offer, you’re essentially invisible to most shoppers—and Amazon won’t show your Sponsored Products ads at all. Understanding and maintaining Featured Offer eligibility is not optional for Amazon advertisers; it’s the fundamental prerequisite that makes advertising possible.

Critical Requirement: Amazon’s FAQ explicitly states that if you create an ad for a listing not eligible for the Featured Offer, the ad will not display. Amazon’s new advertiser success guide recommends choosing products that win the Featured Offer at a high rate—ideally 90% or higher—and are in stock.

Featured Offer Factors:

- Competitive pricing within market range

- Fulfillment method (FBA strongly preferred)

- Seller performance metrics (Order Defect Rate, shipping speed)

- Customer feedback rating

- Inventory availability

Action Item: Monitor Featured Offer percentage in Seller Central. Never advertise products where you don’t consistently own the Featured Offer.

Listing Optimization Checklist

Your product listing IS your landing page on Amazon. Unlike Google or Meta advertising, you cannot create custom landing pages—every visitor from your ads lands on your product detail page. The quality of that page directly determines your conversion rate and advertising efficiency. Amazon lists baseline content quality as part of the “audit your product detail pages” step in their new advertiser success guide. The following elements should be optimized before scaling advertising spend.

Product Title: Primary keywords at the beginning, followed by key features, brand name. Target 80-200 characters (80 minimum for mobile optimization). Avoid keyword stuffing, special characters, and promotional language.

Bullet Points: Use all five available. Lead with benefits, follow with features. Include relevant keywords naturally. Address common customer questions preemptively.

Images: Minimum one main image (white background, product only, minimum 1000px) plus five secondary images. Include lifestyle shots, infographics, size comparisons, and feature callouts. Video significantly boosts engagement where available.

A+ Content: Available for Brand Registry sellers. Research indicates 8-20% conversion rate improvement from quality A+ Content. Include comparison charts, enhanced imagery, and brand story.

Backend Keywords: Invisible to customers but indexed for search. Include synonyms, alternate spellings, and terms that don’t fit naturally in visible content.

Review Thresholds

Social proof is essential to Amazon conversion. Products without reviews—or with poor reviews—struggle to convert regardless of how much advertising budget you invest. Understanding minimum review thresholds helps you set realistic expectations for new product launches.

Products lacking social proof convert poorly regardless of advertising investment. Most categories require 15+ reviews and 3.5+ star rating before advertising delivers acceptable returns.

Review Acceleration Tactics:

- Amazon Vine program (eligible Brand Registry sellers)

- Request a Review button (manual but effective)

- Insert cards encouraging reviews (within Amazon TOS)

- Exceptional customer experience generating organic reviews

Warning: Never solicit fake reviews—Amazon permanently bans violators and removes listing history.

Inventory Management

Running out of stock doesn’t just stop your sales—it destroys the organic ranking you’ve worked to build and wastes the advertising investment that drove velocity. Inventory management may seem like an operations problem, but it has direct implications for advertising strategy.

The relationship between inventory, advertising, and organic rank means that stockouts create compounding damage that takes weeks to recover from.

Pre-Advertising Checklist:

- Minimum 30 days inventory before launching campaigns

- Calculate expected velocity increase from advertising

- Set restock alerts with safety buffer

- Consider FBA for improved shipping speed and Featured Offer probability

Inventory-Advertising Relationship:

- stockouts = ads pause + organic rank decline + potential listing suppression

- low stock = reduced Featured Offer eligibility = wasted ad spend

Recommendation: Implement automated rules to pause or reduce bids when inventory falls below threshold.

PART 9: FOR EXPERIENCED ADVERTISERS – PLATFORM TRANSITIONS

If you’re coming to Amazon with experience from Google, Meta, TikTok, or other advertising platforms, you bring valuable skills—but you also bring assumptions that may not apply on Amazon. Understanding what transfers and what doesn’t is essential for avoiding costly mistakes during your transition.

This section addresses the specific challenges and opportunities faced by experienced digital advertisers new to Amazon, highlighting the critical differences that require adjustment and the skills that provide immediate advantage.

Amazon vs. Google Ads: Critical Differences

Google and Amazon both serve ads against search queries, which creates surface-level similarity that can be misleading. The underlying dynamics—user intent, auction mechanics, and the relationship between paid and organic—differ fundamentally. Understanding these differences helps you calibrate expectations and adapt your strategies appropriately for the Amazon environment.

Intent: Google captures users across the intent spectrum; Amazon captures users at the decision point. Amazon’s average conversion rate of 9.96-10.33% reflects this—users arrive ready to buy, not research.

Organic Impact: This is the crucial difference. Amazon advertising directly improves organic rankings through sales velocity. Google ads have minimal organic SEO impact. On Amazon, advertising investment compounds through improved organic visibility.

Landing Pages: Google advertisers obsess over landing page optimization. On Amazon, your product listing IS your landing page—you cannot create custom pages. This requires shifting optimization focus from ad creative to listing quality.

Metrics Translation: Google uses ROAS; Amazon uses ACoS. They’re inverses: 25% ACoS = 4× ROAS; 20% ACoS = 5× ROAS. TACoS (Total ACoS) has no Google equivalent—it measures advertising’s impact on total business including organic.

Amazon vs. Meta Ads: Critical Differences

Meta’s advertising strength lies in interest-based targeting and creative storytelling. Amazon’s strength lies in capturing existing purchase intent. These different strengths require different strategic approaches. The creative skills developed for Meta advertising have limited direct application on Amazon, where listing quality matters more than ad creative.

Targeting Philosophy: Meta targets based on interests and behaviors inferred from social activity. Amazon targets based on actual purchase behavior—what people buy, not what they “like.” This makes Amazon’s intent signal significantly stronger.

Creative Focus: Meta success depends heavily on ad creative quality. Amazon success depends on listing quality—ads auto-populate from your product images and copy. Shift creative optimization investment from ads to listings.

Funnel Position: Meta operates top-to-mid funnel (awareness, consideration). Amazon operates bottom funnel (conversion). Strategic implication: Meta builds demand; Amazon captures demand.

Attribution: Meta provides engagement metrics and pixel-based conversion tracking. Amazon provides closed-loop purchase data within its ecosystem—you know exactly what drove sales, but lose visibility outside Amazon.

Common Transition Mistakes

Even experienced advertisers make predictable mistakes when transitioning to Amazon. Being aware of these common pitfalls helps you avoid them and accelerate your path to proficiency.

Over-reliance on automation too early: Google advertisers trust automated bidding quickly. Amazon’s automation is less sophisticated—start with “Dynamic Bids – Down Only” or Fixed Bids for 7-14 days before enabling aggressive automation.

Ignoring organic rank impact: Google/Meta advertisers view ads and organic as separate channels. On Amazon, pausing ads can tank organic visibility. Monitor keyword rank alongside ACoS—a high-ACoS keyword may still be valuable if building organic position.

Wrong success metrics: Google optimizes for CTR, Quality Score, CPA. Meta optimizes for engagement, CPM efficiency. Amazon optimizes for ACoS at campaign level, TACoS at business level. Obsessing over ACoS alone is “winning the battle but losing the war.”

Creative assumptions from Meta: Meta advertisers focus on ad creative optimization. On Amazon, your listing IS your creative. Invest in listing optimization—images, titles, A+ Content—not ad variations.

Skills That Transfer Easily

Not everything requires relearning. Many core advertising skills transfer directly to Amazon, providing you with advantages over advertisers who are new to digital marketing entirely.

Keyword research fundamentals translate directly—match types, negative keywords, and search term analysis follow similar principles. Audience understanding, testing methodologies, data analysis skills, budget management expertise, and bidding strategy knowledge all provide foundation for Amazon success.

The adaptation involves applying these skills to Amazon’s unique context: purchase-intent users, listing-as-landing-page, and the organic-paid feedback loop.

Learn more: Amazon’s Ads Academy

PART 10: CATEGORY PLAYBOOKS FOR VERTICALS

Different product categories exhibit different shopper behaviors, competitive dynamics, and advertising opportunities. What works in Beauty may fail in Electronics; strategies effective for Food & Beverage may be wrong for Apparel. This section provides category-specific playbooks that capture the unique characteristics of major Amazon categories. Use these as starting templates to customize based on your specific products and competitive position.

Beauty and Personal Care Ads on Amazon

Beauty is one of Amazon’s most competitive and sophisticated advertising categories. Shoppers respond strongly to visual content, trust signals, and ingredient-based differentiation. Success requires combining strong creative assets with precise targeting strategies.

Consumer Behavior: Strong response to trust signals (reviews, before/after, ingredients, compatibility). Benefit from short-form visual demonstration. Amazon Ads case studies for beauty lean on full-funnel video + Store landing pages.

Recommended Formats: Sponsored Brands Video for discovery and differentiation. Sponsored Products exact match on high-intent ingredient/benefit terms (“niacinamide,” “ceramides,” “acne,” “hyperpigmentation”). Sponsored Display purchases remarketing for replenishment.

Subcategory Nuances: Skincare: benefit + ingredient keywords, video demos. Makeup: shade/finish keywords volatile, use Store curation. Haircare: demonstrate outcomes in first 2-3 seconds. Fragrances: discovery + gifting focus. Grooming: high replenishment, purchases remarketing.

Food and Beverages Ads on Amazon

Grocery and snacks present unique challenges: lower average order values, high purchase frequency, and significant price sensitivity. Advertising strategies must focus on tight ACoS control while building replenishment and trial behavior.

Consumer Behavior: Lower AOV, higher frequency, price/promotion sensitive. Requires tighter ACoS control and replenishment + trial logic.

Recommended Formats: Sponsored Products as conversion workhorse (“mac and cheese,” “protein snack,” “sparkling water”). Sponsored Brands + Store for portfolio discovery with multiple flavors/pack sizes.

Keyword Strategy: Prioritize pack-size modifiers (“12 pack,” “variety pack”), dietary tags (“gluten free,” “keto”), and occasion words (“lunchbox,” “party”).

Health and Wellness Ads on Amazon

Supplements and wellness products require education and trust-building that many other categories don’t. Purchase cycles are often longer, and compliance requirements constrain messaging. Full-funnel sequencing is particularly important in this category.

Consumer Behavior: Requires education and trust; longer purchase cycles. Benefits from full-funnel sequencing: awareness → education → conversion.

Recommended Formats: Sponsored Brands Video + Brand Store for explanation. Amazon DSP for audience segmentation by intent clusters (heart health vs immunity). Sponsored Display purchases remarketing for repeat cycles (e.g., 30-day supply).

Keyword Strategy: Organize by outcomes (sleep, stress relief), ingredients (adaptogens), and form factor (gummies, liquid).

Household Products Ads on Amazon

Household categories are heavily dominated by generic search terms with intense competition. Winning requires disciplined search capture combined with strategic differentiation through rich content placements.

Consumer Behavior: Heavily generics-driven (“laundry pods,” “all-purpose cleaner”), intense competition, frequent “substitute” behavior.

Recommended Formats: Sponsored Products exact for top generics. Sponsored Brands + Stores for cross-sell (bundles, sizes, eco alternatives). Display ads contextual for reach.

Keyword Strategy: Build around “task + surface”: “bathroom mold,” “kitchen degreaser,” “HE laundry detergent.” Use category targeting refinements to avoid irrelevant adjacency.

Pet Care Ads on Amazon

Pet categories blend emotional appeal with practical replenishment needs. Retention and repeat purchase are major profit drivers, making lifetime value calculations particularly important.

Consumer Behavior: Blends emotion (care) and practicality (replenishment). Retention and repeat purchase are major profit drivers; NTB acquisition matters, but lifetime value is often the real prize.

Recommended Formats: Sponsored Products for high-intent food keywords. Sponsored Brands Video to differentiate on quality/sustainability. Display ads purchases remarketing for reorders and cross-sells (treats, supplements, litter).

Keyword Strategy: Cluster by animal + life stage + condition (“senior dog joint,” “kitten wet food”).

Baby Care Ads on Amazon

Baby shopping is trust-heavy, with safety and efficacy concerns paramount. Creatives and product detail pages must communicate clarity and compliance while building confidence with anxious new parents.

Consumer Behavior: Trust-heavy (safety, sensitive skin, efficacy). Creatives and PDPs need clarity and compliance; discounts and messaging affect KPI tradeoffs.

Recommended Formats: Sponsored Brands Video + Stores for curated exploration. Sponsored Products exact on “diapers size X,” “hypoallergenic wipes.” Amazon DSP with baby-specific creative guidance.

KPI Note: Amazon research shows discount messaging can increase DPVR and purchase rate/ROAS while sometimes reducing CTR—illustrating the KPI tradeoff in baby categories.

Electronics and Gadgets Ads on Amazon

Electronics buyers compare specs, read reviews, and often have longer consideration cycles with multiple touchpoints. Video and retargeting sequences are disproportionately valuable in this category.

Consumer Behavior: Spec comparison, review reading, longer consideration cycles. Video and retargeting sequences disproportionately valuable.

Recommended Formats: Sponsored Brands Video as strong differentiator. Sponsored Products exact for high-intent specs queries (“wireless earbuds ANC,” “Wi-Fi camera 2K”). DSP + Streaming TV for sequential messaging.

Apparel and Accessories Ads on Amazon

Fashion categories are highly influenced by brand switching and trend moments. Many shoppers reevaluate brand choices frequently, increasing the value of awareness and creative differentiation beyond just bid pressure.

Consumer Behavior: Highly influenced by brand switching and “trend moments.” Shoppers reevaluate brand choices frequently, increasing awareness value.

Recommended Formats: Sponsored Brands (image + video) for brand recall and Store exploration. Display ads contextual for off-Amazon reach. Key events Store prep to align with seasonal campaigns.

Key Insight: Creative refresh cadence matters more than in other categories.

Specialty and Seasonal Products Ads on Amazon

Seasonal categories experience predictable but intense spikes that can make or break annual performance. CPC inflation, inventory pressure, and deal-driven competition require careful preparation and disciplined execution.

Consumer Behavior: Predictable but brutal spikes: CPC inflation, inventory pressure, deal-driven competition.

Recommended Formats: Coordinated Sponsored Products + Sponsored Brands + Display with curated Store pages. Budget and bid rules for predictable seasonal dates (Prime Day, Halloween, Christmas).

Key Insight: Use Amazon’s Prime Day advanced strategies as a general tentpole template. Amazon reports coordinated strategies during Prime Day drove sales increases relative to category growth.

PART 11: TOOLS, SOFTWARE, AND AGENCIES

As your Amazon advertising program grows in complexity, the question of tools and management structure becomes increasingly important. The right tools can dramatically improve efficiency; the wrong ones can add cost without value. Similarly, the decision to manage advertising in-house versus through an agency has significant implications for outcomes and cost.

This section provides an overview of the tool landscape and frameworks for making the build-versus-buy decisions that shape how your advertising program operates.

Amazon’s Native Tools

Before investing in third-party tools, it’s worth understanding the full range of capabilities Amazon provides natively. Many advertisers underutilize these free resources, which continue to improve with regular updates and new features.

- Brand Analytics: search query performance, market basket analysis, repeat purchase behavior, demographics. Available to Brand Registry sellers. Provides competitive insights unavailable elsewhere.

- Search Query Performance Report: share of purchases, clicks, and impressions by search term—identifying keyword opportunities and competitive gaps.

- Campaign Manager: standard campaign creation, management, and reporting. Recent improvements include unified interface for sponsored ads and DSP.

- Manage Your Experiments: A/B testing for titles, images, bullets, descriptions, and A+ Content with statistical significance reporting.

Third-Party Tools

A robust ecosystem of third-party tools has emerged to address gaps in Amazon’s native capabilities and provide automation, analytics, and optimization features beyond what Amazon offers directly.