Table of Contents

Advertising on Whole Foods represents a different discipline from mass-market retail media. While platforms like Amazon.com and Walmart optimize for scale, price sensitivity, and transactional velocity, Whole Foods operates on a distinct axis: trust, curation, and long-term brand value. This guide provides a comprehensive framework for brands and sellers seeking to navigate the Whole Foods ad ecosystem well.

Being stocked at Whole Foods Market already communicates powerful signals to consumers: ingredient quality, supply chain credibility, regulatory and ethical compliance, and brand maturity. Advertising in this context does not create trust—it leverages trust that already exists. This fundamental difference shapes everything from creative priorities and funnel sequencing to acceptable customer acquisition costs and ROI time horizons.

This guide covers the complete Whole Foods advertising ecosystem, including Sponsored Products, Sponsored Brands, Sponsored Display, Amazon DSP integration, and in-store digital signage. You will learn targeting strategies optimized for the Whole Foods shopper, performance metrics that matter, retail readiness requirements, and category-specific playbooks for Food & Beverage, Supplements & Wellness, and Household & Personal Care.

Prior to reading this guide, for all technicalities and explanations read our Amazon Ads Guide – it’ll help you.

Part 1: Why Whole Foods Advertising Is a Distinct Discipline

Advertising around Whole Foods is not about winning auctions. It is about earning durable presence in a retail environment where trust compounds over time. Brands that understand this distinction do not just grow sales—they build defensible demand. They invest in customer lifetime value rather than immediate conversion. They tell stories rather than just display products. They measure what matters rather than what is easy to track.

Whole Foods Market is not just another retailer with ad inventory. It is a signal amplifier. The distinction matters for every advertising decision you make. Higher acquisition costs are offset by higher lifetime value, stronger loyalty, and brand equity that transfers across channels. In a retail landscape increasingly dominated by price competition, Whole Foods offers something rare: the opportunity to compete on value rather than cost.

Whole Foods’ Trust Premium

When a product appears on Whole Foods shelves, consumers make immediate inferences about quality. This pre-existing trust changes the advertising equation fundamentally:

- Creative priorities shift from establishing credibility to reinforcing value propositions

- Funnel sequencing emphasizes awareness and education over immediate conversion

- Metrics that matter extend beyond immediate ROAS to lifetime value and repeat purchase rate

- Acceptable CAC levels are higher because customer lifetime value is higher

- ROI time horizons extend to account for brand equity compounding

Brands that treat Whole Foods advertising like Amazon FBA ads usually underperform. Brands that treat it like premium retail media compound value over time. The difference is not tactical—it is philosophical. Whole Foods advertising rewards patience, brand storytelling, and alignment with consumer values over short-term efficiency optimization.

Part 2: The Whole Foods Retail Media Ecosystem

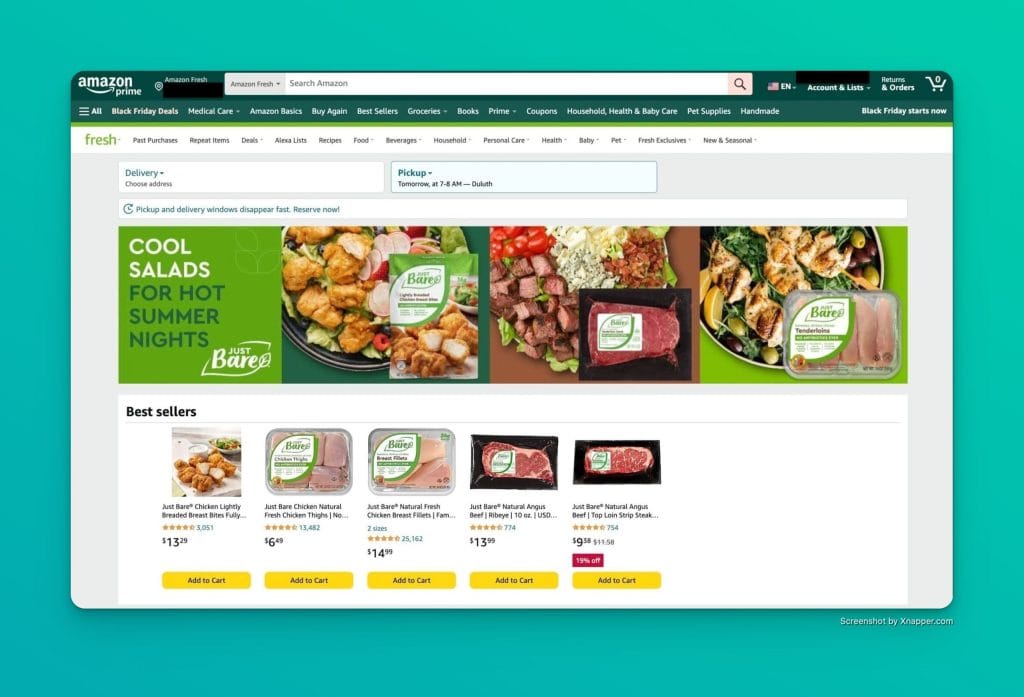

Whole Foods Is Inside Amazon—But Is Not the Same as Amazon Ads

Since Amazon’s acquisition in 2017, Whole Foods operates within Amazon’s infrastructure while maintaining its distinct identity and standards. Understanding this relationship is essential for effective advertising.

Differences Whole Foods vs Amazon

| Dimension | Amazon.com | Whole Foods Market |

| Assortment | Open marketplace with millions of sellers | Curated selection meeting strict quality standards |

| Success Metric | Selection velocity and conversion rate | Fit with brand standards and customer values |

| Shelf Space | Virtually unlimited digital inventory | Constrained physical and digital presence |

| Store Role | Fulfillment centers for digital orders | Central customer experience touchpoint |

| Competitive Dynamic | Price-driven comparison shopping | Quality and values-driven selection |

Three Overlapping Advertising Environments

Advertising around Whole Foods spans three interconnected environments:

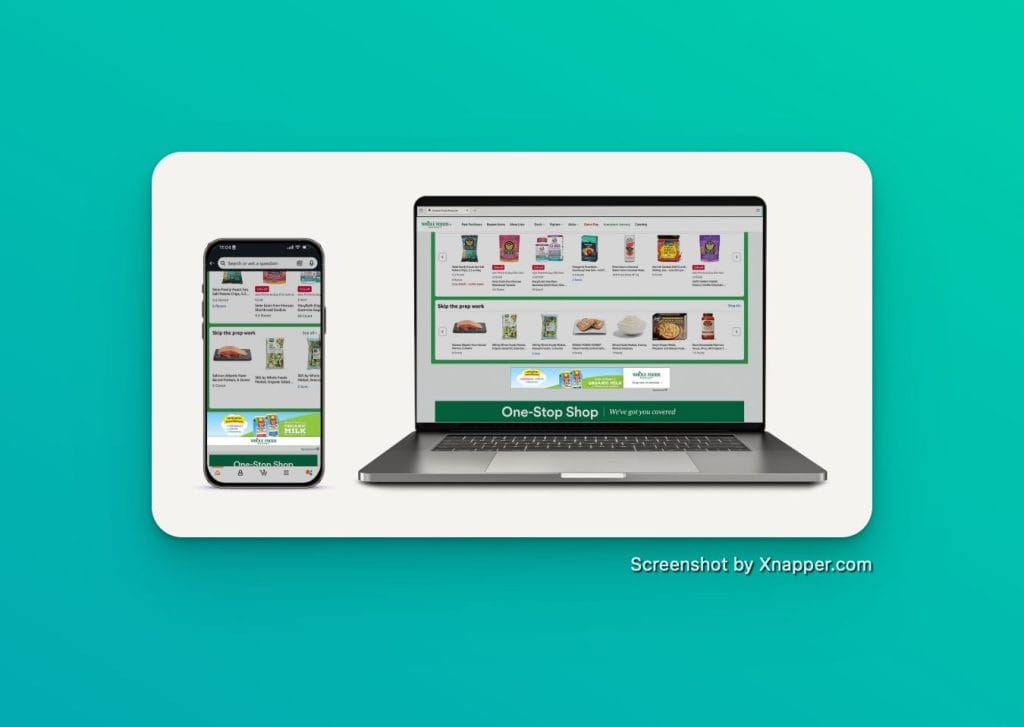

- Amazon Retail Surfaces: sponsored Products, Sponsored Brands, and Sponsored Display appearing on Amazon.com, Amazon Fresh, and Whole Foods Market online stores

- Amazon DSP: programmatic display and video advertising across Amazon-owned properties and third-party exchanges, with Whole Foods-specific audience targeting

- Physical Retail Media: in-store digital signage, end caps, shelf talkers, displays, and sampling programs

The ecosystem is smaller than Amazon.com, but the signal density is much higher. Each impression reaches a more qualified, higher-intent audience.

Part 3: How Whole Foods Ads Work

Unlike others networks, Whole Foods Market’s media network does not offer a fully standalone, self-serve advertising platform. Instead, access happens through multiple channels within the Amazon Ads ecosystem.

Ad Access Pathways

| Access Method | Requirements | Ad Types Available |

| Amazon Ads Console | Eligible WFM ASINs, active selling account | Sponsored Products, Sponsored Brands, Sponsored Display |

| Amazon DSP (Self-Service) | Minimum $10K spend, DSP seat access | Display, Video, OTT, In-Store Digital Signage |

| Amazon DSP (Managed Service) | Minimum $35K-50K spend commitment | Full DSP capabilities + SOV placements + Landing Pages |

| Physical Retail Programs | Active WFM vendor relationship, category buyer approval | End caps, shelf talkers, in-store displays, sampling |

- Not every brand can advertise: Products must meet Whole Foods quality standards and be listed for sale

- Not every SKU is eligible: Only ASINs actively sold by Whole Foods or Amazon Fresh can run Sponsored Ads

- DSP is often the first serious scaling lever: For Whole Foods brands, DSP provides reach and targeting capabilities that Sponsored Ads alone cannot deliver

- This structure favors brands with clarity about their positioning and objectives, not brands seeking to experiment chaotically.

Part 4: Whole Foods Ad Formats

1. Sponsored Products (Whole Foods-Eligible ASINs)

Sponsored Products appear on Amazon search results and product detail pages when the ASIN meets specific eligibility criteria:

- Product is sold by Whole Foods Market or Amazon

- Inventory is Prime-eligible

- Product is available for delivery or pickup from Whole Foods locations

Key Differences from Standard Sponsored Products

| Characteristic | Standard Amazon | Whole Foods |

| Keyword Saturation | High competition, costly bids | Lower saturation, more efficient reach |

| Conversion Trust | Varies by seller reputation | Higher baseline from WFM association |

| Purchase Behavior | One-time and subscription | Strong replenishment patterns |

| Best Categories | All consumer products | Pantry staples, beverages, supplements, household essentials |

2. Sponsored Brands (Portfolio & Narrative Control)

Sponsored Brands play a larger strategic role for Whole Foods brands than for mass-market sellers. The reason is fundamental: Whole Foods shoppers care about the brand behind the product. Discovery often precedes intent, and multi-SKU baskets are common.

Effective Sponsored Brands Campaigns Should:

- Lead to Brand Stores curated around values, not just products

- Emphasize ingredient philosophy and sourcing transparency

- Group SKUs by use-case rather than price tier

3. Sponsored Display

In November 2022, Amazon expanded Sponsored Display to Amazon Fresh and Whole Foods Market online stores. This launch opened new opportunities for brands to extend reach, page-visit, or conversion-optimized campaigns to grocery shoppers.

Sponsored Display Capabilities for Whole Foods

- Promote Amazon Fresh and Whole Foods Market offers across WFM, Fresh, and Amazon.com

- Target audiences based on shopping behavior and product views

- Retarget shoppers who have viewed or purchased similar products

4. Amazon DSP—The Core Growth Engine

For Whole Foods brands, DSP is not optional. It is the backbone of scalable growth. Through Amazon DSP, brands unlock capabilities that Sponsored Ads cannot provide.

DSP Capabilities for Whole Foods Brands

| Capability | Description | Strategic Value |

| Whole Foods Shopper Audiences | Target shoppers who purchased in WFM physical stores with custom lookback windows up to 365 days | Reach verified premium grocery shoppers |

| Category-Level Audiences | Target WFM shoppers by category: Produce, Dairy, Refrigerated, etc. | Precision targeting by shopping behavior |

| In-Store Attribution | Measure impact of digital ads on physical store purchases | Closed-loop measurement for omnichannel campaigns |

| Prime Video Placements | Video ads on Prime Video streaming content | Brand building with engaged audiences |

| WFM Walled Garden Display | Priority placements within WFM online environment | Premium visibility to high-intent shoppers |

| Off-Amazon Reach | Programmatic display across third-party exchanges | Extend reach beyond Amazon ecosystem |

DSP enables Whole Foods advertising to move from transactional capture to demand shaping—reaching consumers before they enter the purchase funnel and influencing their consideration set.

Specs for Whole Foods Ads on Amazon DSP

Desktop

| Display Size | Max. File Weight | File Format |

| 160×600 px | 40 kb static | JPG / PNG-8 |

| 300×250 px | 40 kb static | JPG / PNG-8 |

| 300×600 px | 50 kb static | JPG / PNG-8 |

| 728×90 px | 40 kb static | JPG / PNG-8 |

| 970×250 px | 200 kb static | JPG / PNG-8 |

Mobile

| Display Size | Creative Dimensions | Max. File Weight | File Format |

| 320 x 50 px | 640 x 100 px @2X (required) | 20 kb | JPG / PNG-8 |

| 414 x 125 px | 828 x 250 px @2X (required) | 100 kb | JPG / PNG-8 |

| 300 x 250 px | 600 x 500 px @2X (required) | 40 kb | JPG / PNG-8 |

| 728×90 | 1456 x 180 px @2X (required) | 40 kb | JPG / PNG-8 |

5. In-Store Digital Signage

As of April 2024, Amazon launched in-store digital signage advertising across Whole Foods Market and Amazon Fresh stores. This represents a significant expansion bridging digital and physical retail.

Digital Signage Key Features

- Available through Amazon DSP (self-service and managed service)

- Reaches customers at the shelf during active shopping

- Amazon research shows 16% boost in brand awareness and 12% increase in purchase intent

- Available to both endemic (grocery) and non-endemic advertisers with approval

6. Physical Retail Media & In-Store Activation

Traditional physical placements remain limited but powerful trust accelerators:

| Placement Type | Description | Best Use Case |

| End Caps | High-visibility displays at aisle ends | New product launches, seasonal promotions |

| Shelf Talkers | Point-of-purchase signage on shelving | Highlighting certifications, value propositions |

| In-Store Displays | Freestanding branded displays | Brand storytelling, cross-category bundling |

| Sampling Programs | Product demonstrations and tastings | Trial generation, immediate feedback collection |

These are not performance channels in the narrow sense—they are trust accelerators that work best when paired with DSP awareness and supported by Sponsored Products for replenishment.

Part 5: Targeting Strategies for Whole Foods Ads

Understanding the Whole Foods Shopper

Whole Foods shoppers are not bargain hunters. They represent a distinct consumer profile with specific motivations:

- Ingredient-aware: they read labels and understand what goes into their food

- Health-motivated: wellness is a priority, not an afterthought

- Values-aligned: they want to support companies that share their environmental and social values

- More loyal once converted: higher lifetime value offsets higher acquisition costs

The Inverted Funnel Strategy

Effective targeting for Whole Foods brands prioritizes lifestyle clusters, dietary frameworks, health outcomes, and purchase behavior over search volume. In practice, this flips the classic Amazon advertising hierarchy:

| Traditional Amazon Hierarchy | Whole Foods Hierarchy |

| 1. Sponsored Products (bottom-funnel) | 1. DSP (top-funnel awareness) |

| 2. Sponsored Brands (mid-funnel) | 2. Sponsored Brands (mid-funnel education) |

| 3. DSP (top-funnel) | 3. Sponsored Products (bottom-funnel capture) |

Key Audience Segments

| Audience Segment | DSP Targeting Approach | Use Case |

| WFM Physical Store Purchasers | Custom audiences with 365-day lookback | Retargeting, loyalty building |

| Category Purchasers | LS-Whole Foods Market [Category] Offline Customers | Category conquest, cross-selling |

| Organic/Natural Lifestyle | Lifestyle segments for organic, clean-label shoppers | New customer acquisition |

| Health & Wellness Enthusiasts | In-market audiences for supplements, fitness | Awareness for wellness products |

| Prime Members in WFM Zipcodes | Geographic + Prime membership targeting | Drive store visits |

Part 6: Whole Foods Metrics

Short-term efficiency metrics alone are misleading in the Whole Foods context. The premium shopper base and higher customer lifetime value require a different measurement framework.

Key Indicators

| Metric | Definition | Why It Matters for WFM |

| New-to-Brand (NTB) | Customers purchasing your brand for the first time | Measures true customer acquisition vs. existing customer retention |

| Repeat Purchase Rate | % of customers who purchase again within 90 days | Validates product-market fit with WFM shoppers |

| Basket Expansion | Number of SKUs per order | Indicates brand portfolio strength |

| Customer Lifetime Value (CLV) | Total revenue from a customer over time | Justifies higher acquisition costs |

| TACoS (Total ACoS) | Ad spend as % of total sales (not just ad-attributed) | Shows advertising efficiency across all channels |

| Offline + Online Halo | In-store sales lift from digital campaigns | Captures omnichannel impact of advertising |

Measurement Integration

Amazon DSP provides in-store attribution for Whole Foods purchases made by Prime members. This closed-loop measurement enables:

- Tracking digital ad exposure to physical store purchases

- Geographic testing of campaigns before national rollout

- Understanding which digital placements drive in-store behavior

Brands that optimize only for immediate ROAS tend to underinvest in the very signals that Whole Foods shoppers reward. Patience and measurement sophistication are competitive advantages.

Part 7: Retail Readiness is KEY

Whole Foods advertising amplifies strengths and exposes weaknesses. Before scaling spend, brands must have their foundation in place.

Whole Foods Quality Standards

Products sold at Whole Foods must meet rigorous quality standards:

- No artificial preservatives, colors, flavors, sweeteners, or hydrogenated fats

- Over 100+ ingredients on the unacceptable ingredients list

- Non-GMO claims require third-party verification (Non-GMO Project or USDA Organic)

- Regenerative Organic Certification (ROC) receives priority consideration

Retail Readiness Checklist

| Area | Requirement | Advertising Impact |

| Ingredient Compliance | All ingredients must be on WFM approved list | Ads for non-compliant products will be rejected |

| Labeling | Clear ingredient listing, compliant claims | Creative must match on-pack claims exactly |

| Supply Chain | Reliable inventory, 30-60 day lead times | Stock-outs waste ad spend and damage rankings |

| Packaging | Clear communication of value proposition | Creative extends packaging story |

| Margin Structure | Minimum 40% margin for grocery categories | Ensures profitability at scale |

| Insurance & Certification | Liability insurance, food safety certifications | Required for vendor status |

Key Principle: Advertising cannot compensate for misalignment with Whole Foods standards. It simply makes misalignment visible faster.

Part 8: Category-Specific Strategic Playbooks

Food & Beverage

| Strategy Element | Approach |

| Primary Objective | Drive awareness, trial, and replenishment |

| DSP Focus | Awareness and education about ingredients, sourcing, health benefits |

| Sponsored Products | Capture replenishment searches for pantry staples |

| In-Store | Sampling where possible to drive trial |

| Key Metrics | NTB rate, repeat purchase velocity, basket size |

| Creative Emphasis | Origin stories, ingredient sourcing, functional benefits |

Supplements & Wellness

| Strategy Element | Approach |

| Primary Objective | Education-first approach building category credibility |

| DSP Focus | Target health-motivated audiences, avoid over-promising |

| Sponsored Products | Conservative claims, focus on compliant copy |

| Brand Store | Strong structure with educational content, certifications |

| Key Metrics | Customer lifetime value, subscription rate |

| Creative Emphasis | Third-party certifications, transparent sourcing, clinical studies |

Household & Personal Care

| Strategy Element | Approach |

| Primary Objective | Demonstrate value through sustainability and quality |

| DSP Focus | Sustainability proof points, eco-conscious audiences |

| Sponsored Products | Multi-SKU bundles for value signaling |

| In-Store | Packaging visibility, ingredient transparency |

| Key Metrics | Brand switching rate, multi-product adoption |

| Creative Emphasis | Environmental impact, clean ingredients, packaging sustainability |

Part 9: Whole Foods vs Other Retail Media Networks

| Network | Primary Strength | Shopper Profile | Best For |

| Amazon.com | Scale and immediacy | Price-conscious, convenience-driven | Mass-market products, Prime conversion |

| Instacart | Convenience delivery | Busy professionals, urban dwellers | Grocery staples, same-day needs |

| Walmart | Price and reach | Value-seekers, mainstream consumers | Price-competitive products, EDLP brands |

| Kroger | Regional loyalty | Habitual grocery shoppers | Regional brands, loyalty programs |

| Whole Foods | Trust and lifetime value | Health-conscious, values-driven | Premium, organic, mission-driven brands |

Where Whole Foods Wins

- Brand equity compounds: WFM association builds long-term value

- Retention outweighs impulse: customers return for quality, not deals

- Narrative matters more than discounts: brand storytelling drives purchase decisions

Part 10: Common Strategic Mistakes to Avoid

The most frequent errors in Whole Foods advertising are subtle and expensive:

Mistake 1: Treating Whole Foods Like Amazon FBA

The mass-market playbook does not work here. Aggressive pricing, high-volume SKU strategies, and conversion-focused creative miss the point of why shoppers choose Whole Foods.

Mistake 2: Over-Optimizing for Short-Term ROAS

Whole Foods customers have higher lifetime value. Cutting spend when immediate ROAS dips often sacrifices long-term brand building for short-term efficiency.

Mistake 3: Ignoring Physical-Digital Halo Effects

Digital ads drive in-store purchases. Brands that measure only online conversions dramatically undercount their advertising impact.

Mistake 4: Underinvesting in Brand Storytelling

Whole Foods shoppers want to know the story behind products. Functional ad copy that works on Amazon.com falls flat with values-driven consumers.

Mistake 5: Running Ads Without Retail Readiness

Advertising products that are out of stock, have poor reviews, or lack compliant packaging wastes budget and damages brand perception.

Part 11: The 2026 Outlook for Whole Foods Advertising

Key directional trends shaping Whole Foods advertising:

DSP Becomes the Default Entry Point

As Amazon continues integrating Whole Foods shopper data into DSP, programmatic advertising will become the primary growth lever for premium grocery brands.

Greater Integration with Prime Video

Streaming video advertising with Whole Foods audience targeting enables brand storytelling at scale, reaching consumers during high-attention viewing moments.

Improved In-Store Attribution

The expansion of digital signage and enhanced measurement capabilities will close the loop between digital ad exposure and physical purchase behavior.

Fewer Brands, Higher Spend Per Brand

Whole Foods is not moving downmarket. As competition for shelf space intensifies, winning brands will invest more heavily in integrated advertising programs.

AI-Powered Optimization

Multi-agent AI systems will enable real-time bid optimization, creative testing, and cross-channel budget allocation—giving sophisticated advertisers significant efficiency advantages.

Part 12: How RMIQ Helps Brands Succeed on Whole Foods

Managing Whole Foods advertising effectively requires expertise across multiple platforms, sophisticated measurement capabilities, and strategic patience. RMIQ provides the technology and services brands need to succeed.

RMIQ Platform Capabilities

| Capability | Description | Benefit for WFM Brands |

| Multi-Network Management | Unified campaign management across 20+ retail media networks | Coordinate WFM with Amazon, Instacart, and other channels |

| AI-Powered Optimization | Autonomous agents optimize bids, budgets, and targeting | Maximize efficiency without manual intervention |

| Unified Reporting | Cross-channel performance dashboards | See true omnichannel impact of advertising |

| Whole Foods Keyword Tool | Specialized keyword research for WFM | Discover high-intent search opportunities |

| Performance-Based Pricing | Pay based on results, not flat fees | Align agency incentives with brand outcomes |

| Expert Strategy | Dedicated retail media specialists | Navigate complex ecosystem with experienced guidance |

Why RMIQ Works for Whole Foods Ads

- Deep expertise in premium grocery and natural products advertising

- Technology built for the complexity of retail media networks

- Proven track record with CPG brands selling through Whole Foods

- Strategic focus on long-term brand building, not just short-term ROAS

The brands that succeed on Whole Foods in 2026 and beyond will be those that treat advertising as brand building, not just performance marketing. The tools exist. The audiences are reachable. The measurement capabilities are improving. What remains is the strategic discipline to invest for the long term.