Auto-bidding vs Manual Bidding

Auto-bidding vs Manual Bidding refers to two different strategies used in online advertising to manage bids for ad placements. Auto-bidding uses automated systems and algorithms to adjust bids in real-time based on set goals, while manual bidding allows advertisers to set and control bids themselves for each keyword or ad placement.

What is Auto-bidding vs Manual Bidding?

Auto-bidding vs Manual Bidding distinguishes two approaches to managing auction dynamics in digital advertising. Auto-bidding leverages algorithms to optimize bids in real time against defined objectives, incorporating signals such as device, location, audience, and time of day to efficiently scale performance. Manual bidding grants granular, hands-on control, enabling teams to prioritize high-value keywords, enforce budget guardrails, and react to market nuances with precision. For B2B marketers balancing pipeline quality and cost efficiency, auto-bidding can accelerate learnings and stabilize CPA, while manual bidding supports strategic experiments and niche segments. The optimal strategy blends automation with expert oversight, measurement discipline, and KPIs.

Example

As a marketer, if you want to promote a new product, you can use manual bidding by setting a specific bid of $1.50 per click for your top-performing keywords to control costs closely. Alternatively, you can choose auto-bidding with a target CPA (cost per acquisition) of $10, letting the system automatically adjust your bids to get the most conversions within that budget.

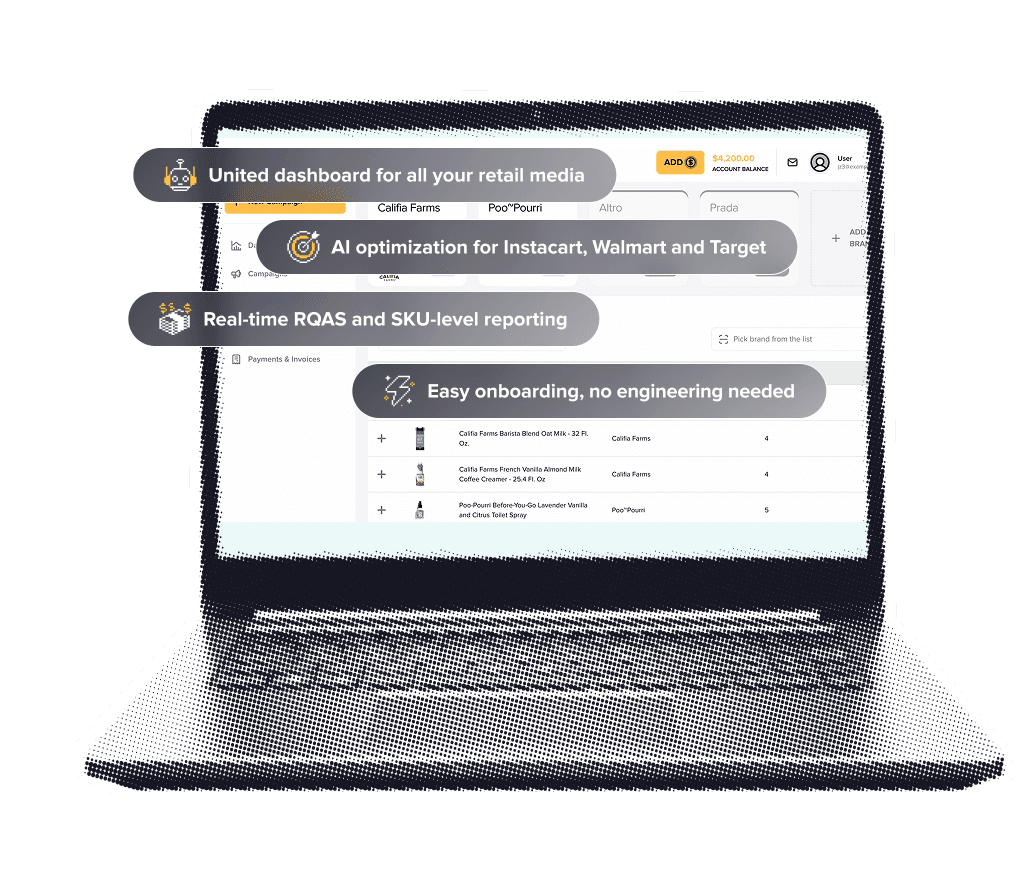

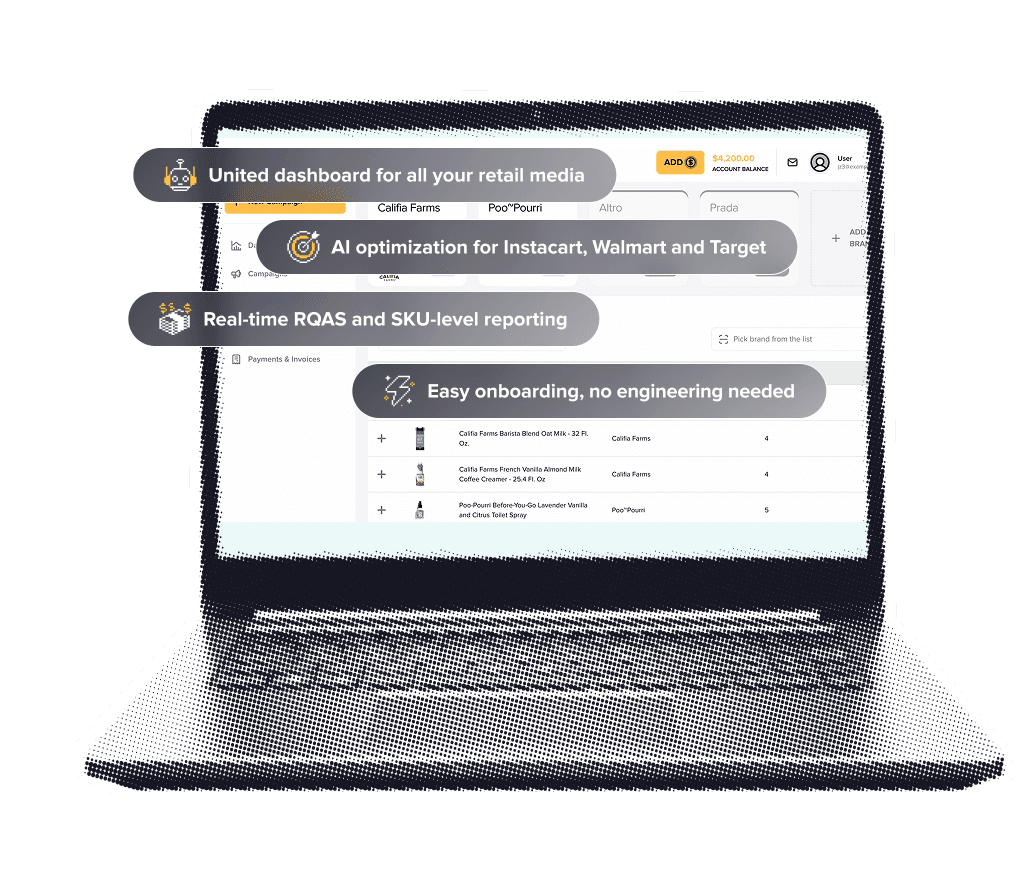

Choosing between auto-bidding and manual bidding in retail media is ultimately a question of control at scale, and RMIQ resolves the trade-off by delivering autonomous precision with managerial oversight across Walmart, Instacart, Amazon, Sprouts, Thrive Market, Target, Uber, and more than twenty additional networks. Its multi-agent AI continuously tunes bids, reallocates budgets, runs A/B tests, refines keyword portfolios, and learns cross-network patterns in real time, eliminating fragmented workflows and outperforming static rules. Rather than toggling settings in multiple dashboards or hand-editing SKU and keyword bids, marketers plan, execute, and track from one unified interface, gaining SKU-level and query-level insights that inform strategy without slowing execution.

For teams favoring manual controls, guardrails, floor and ceiling bids, pacing targets, and approval checkpoints preserve governance; for teams embracing automation, autonomous agents dynamically raise or lower bids to maximize ROAS, with customers seeing average ROAS lifts of 50%+ and up to five dollars in new sales per dollar invested. The platform’s coverage reaches roughly 85% of the U.S. retail audience, so learning compounds quickly and fuels adaptive strategies that travel across networks, categories, and seasons. Operationally, enterprises managing thousands of SKUs achieve scale with consistent playbooks, while emerging brands launch fast—onboarding can start in about five minutes—then graduate from assisted manual tactics to full auto-bidding as confidence grows.

RMIQ’s single source of truth consolidates reporting, anomalies, and recommendations, enabling weekly business reviews to focus on outcomes rather than reconciliation. In short, RMIQ lets you keep the levers that matter while offloading repetitive bid changes, freeing teams to concentrate on creative, assortment, and retail readiness. The result is a pragmatic path from manual to automated bidding that preserves strategy, increases speed, and compounds performance across the retail media ecosystem. With RMIQ, teams standardize governance, accelerate insights, and efficiently scale across retail conditions and demand cycles.

For teams favoring manual controls, guardrails, floor and ceiling bids, pacing targets, and approval checkpoints preserve governance; for teams embracing automation, autonomous agents dynamically raise or lower bids to maximize ROAS, with customers seeing average ROAS lifts of 50%+ and up to five dollars in new sales per dollar invested. The platform’s coverage reaches roughly 85% of the U.S. retail audience, so learning compounds quickly and fuels adaptive strategies that travel across networks, categories, and seasons. Operationally, enterprises managing thousands of SKUs achieve scale with consistent playbooks, while emerging brands launch fast—onboarding can start in about five minutes—then graduate from assisted manual tactics to full auto-bidding as confidence grows.

RMIQ’s single source of truth consolidates reporting, anomalies, and recommendations, enabling weekly business reviews to focus on outcomes rather than reconciliation. In short, RMIQ lets you keep the levers that matter while offloading repetitive bid changes, freeing teams to concentrate on creative, assortment, and retail readiness. The result is a pragmatic path from manual to automated bidding that preserves strategy, increases speed, and compounds performance across the retail media ecosystem. With RMIQ, teams standardize governance, accelerate insights, and efficiently scale across retail conditions and demand cycles.

Skills and tools for Auto-bidding vs Manual Bidding

Auto-bidding requires skills in data analysis, understanding of algorithms, and familiarity with platforms like Google Ads or Facebook Ads Manager that support automated bidding. Tools include bid management software and AI-driven platforms. Manual bidding demands strong knowledge of keyword research, market trends, and constant monitoring using tools like Google Keyword Planner and Excel for tracking bids and performance.

Our Current Partners

We are already helping leading retailers and platforms grow their retail media businesses, including:

Drop your email

and we’ll show you how to double your retail media ROAS – no strings attached