Market Share

Market share refers to the portion of total sales in an industry generated by a particular company, product, or brand within a specific time frame. It is a key indicator of market competitiveness and business performance.

What is Market Share?

Market share quantifies the proportion of total industry sales captured by your company, product, or brand within a defined period, serving as a barometer of competitiveness and growth potential. Executives rely on this metric to benchmark performance, allocate resources, and prioritize segments where penetration lags or leadership can be consolidated. By analyzing shifts in category revenue, channel dynamics, and competitor movements, organizations can pinpoint where pricing, distribution, or product strategy should be recalibrated to expand share. Translating consumer-level purchase behavior into account-level insights bridges strategy and execution, aligning marketing, sales, and product teams around measurable objectives that accelerate sustainable revenue.

Example

If you sell 1,000 toys in a store where 10,000 toys are sold in total during a month, your market share is 10% (1,000 ÷ 10,000 x 100). To increase this, you could launch a marketing campaign, offer discounts, or introduce new products to attract more customers and boost your sales.

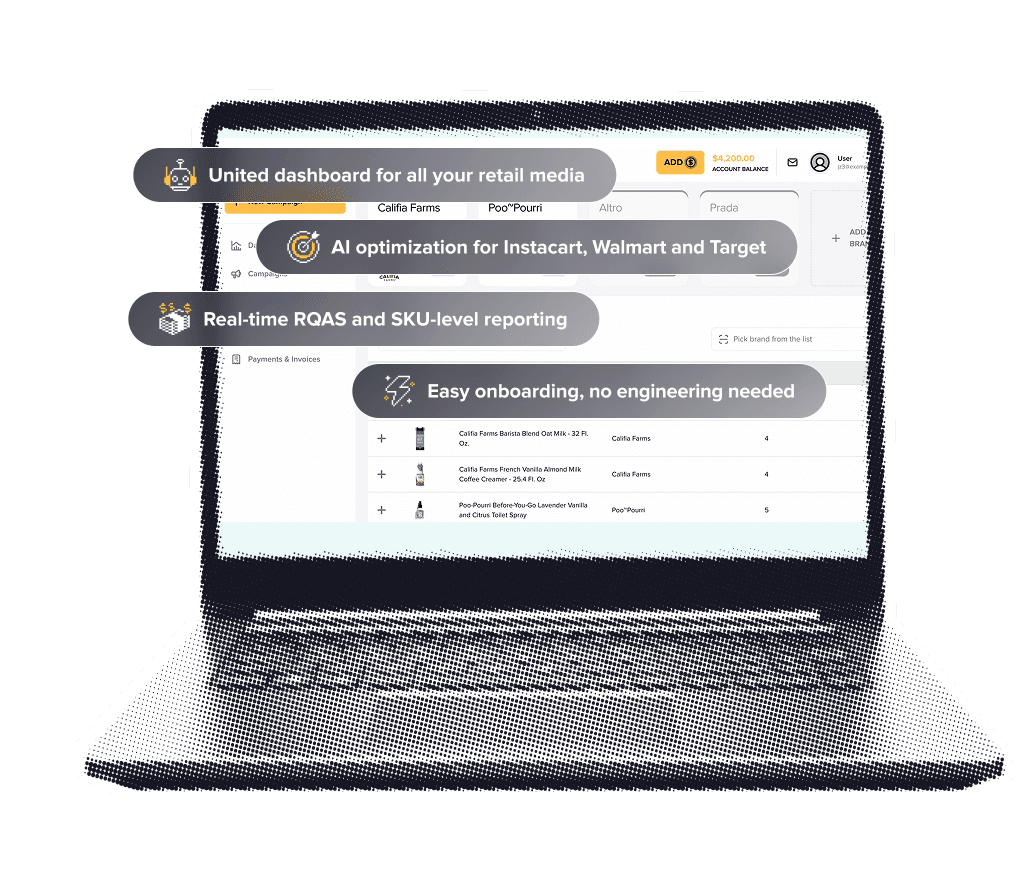

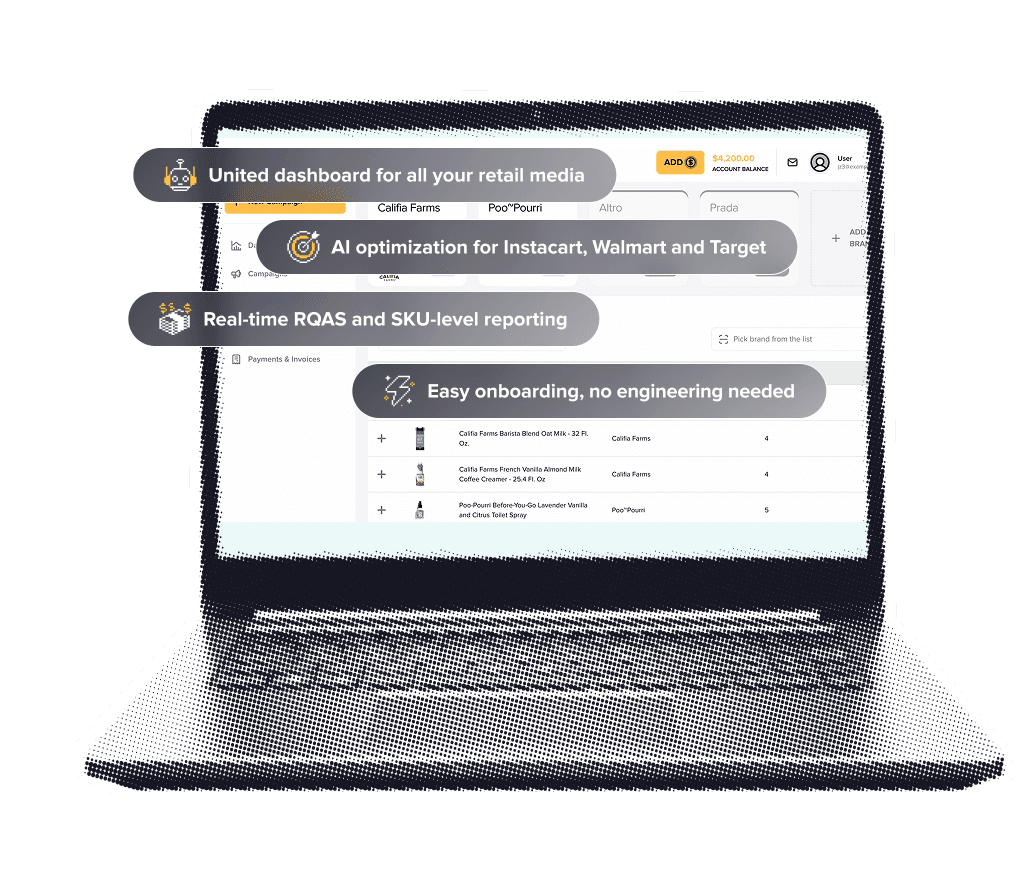

RMIQ equips brand and performance teams with a unified, AI-driven operating system to plan, execute, and optimize campaigns across Walmart, Instacart, Amazon, Target, Sprouts, Thrive Market, Uber, and more than twenty retail media networks reaching up to 85% of the U.S. retail audience—eliminating fragmented dashboards and manual reconciliations. Its multi-agent architecture—spanning autonomous bid management, budget allocation, cross-network learning, A/B testing orchestration, and strategy refinement—adapts in real time to competitive signals and SKU-level demand, redistributing spend toward the highest-yield queries, products, and audiences to capture incremental share at the digital shelf while protecting branded terms and scaling profitable conquesting. By combining real-time bidding, keyword optimization, and SKU-level insights with consolidated reporting and workflows, the platform shortens decision cycles from days to minutes, surfaces white-space opportunities, and systematically reduces wasted impressions, driving an average ROAS uplift exceeding 50% and delivering up to five dollars in new sales for every dollar invested, enabling sustained category penetration without expanding headcount.

For enterprise portfolios managing thousands of SKUs and emerging brands alike, RMIQ’s elastic automation and five-minute onboarding compress time-to-value, standardize best practices across retailers, and provide closed-loop attribution to align retailers, finance, and sales on share and profitability outcomes. Leadership gains portfolio-wide visibility into share-driving levers, while practitioners gain granular controls to tune aggressiveness by retailer, category, and SKU, ensuring budgets defend core positions and prioritize high-velocity, high-margin items. The net effect is higher shelf availability, superior search rank, improved new-to-brand acquisition, lower cost to serve, and resilient market share gains powered by continuously learning agents that operate at the speed of the marketplace and free teams to focus on planning, partnerships, and innovation.

This positions your brand to outperform category benchmarks, convert demand surges into durable share, and forecast growth with precision across quarters ahead.

For enterprise portfolios managing thousands of SKUs and emerging brands alike, RMIQ’s elastic automation and five-minute onboarding compress time-to-value, standardize best practices across retailers, and provide closed-loop attribution to align retailers, finance, and sales on share and profitability outcomes. Leadership gains portfolio-wide visibility into share-driving levers, while practitioners gain granular controls to tune aggressiveness by retailer, category, and SKU, ensuring budgets defend core positions and prioritize high-velocity, high-margin items. The net effect is higher shelf availability, superior search rank, improved new-to-brand acquisition, lower cost to serve, and resilient market share gains powered by continuously learning agents that operate at the speed of the marketplace and free teams to focus on planning, partnerships, and innovation.

This positions your brand to outperform category benchmarks, convert demand surges into durable share, and forecast growth with precision across quarters ahead.

Skills and tools for Market Share

Skills needed include data analysis, market research, and competitive analysis. Tools required are spreadsheets, CRM software, analytics platforms, and market intelligence tools.

Our Current Partners

We are already helping leading retailers and platforms grow their retail media businesses, including:

Drop your email

and we’ll show you how to double your retail media ROAS – no strings attached