Payback Period

The payback period is a financial metric that measures the time required for an investment to generate cash flows sufficient to recover the initial cost. It helps businesses and investors assess the risk and liquidity of a project by indicating how quickly they can expect to recoup their investment.

What is Payback Period?

Understanding the payback period equips decision-makers with a clear view of risk, liquidity, and capital efficiency. This metric calculates how long project cash inflows will take to recover the initial outlay, enabling finance teams to prioritize initiatives that return funds faster, reduce exposure, and improve cash management. By quantifying time-to-recovery, it complements NPV and IRR in portfolio screening, supports gating decisions, and informs stakeholder expectations. Simple to communicate—how long it takes to get back the money you spent—it is especially useful for budgeting constraints, volatile markets, and operational investments, guiding comparative analysis across vendor proposals, technology upgrades, and capacity expansions.

Example

If a marketer invests $10,000 in a new social media campaign that generates $2,500 in profit each month, the payback period is $10,000 ÷ $2,500 = 4 months. This means it will take 4 months to recover the initial investment.

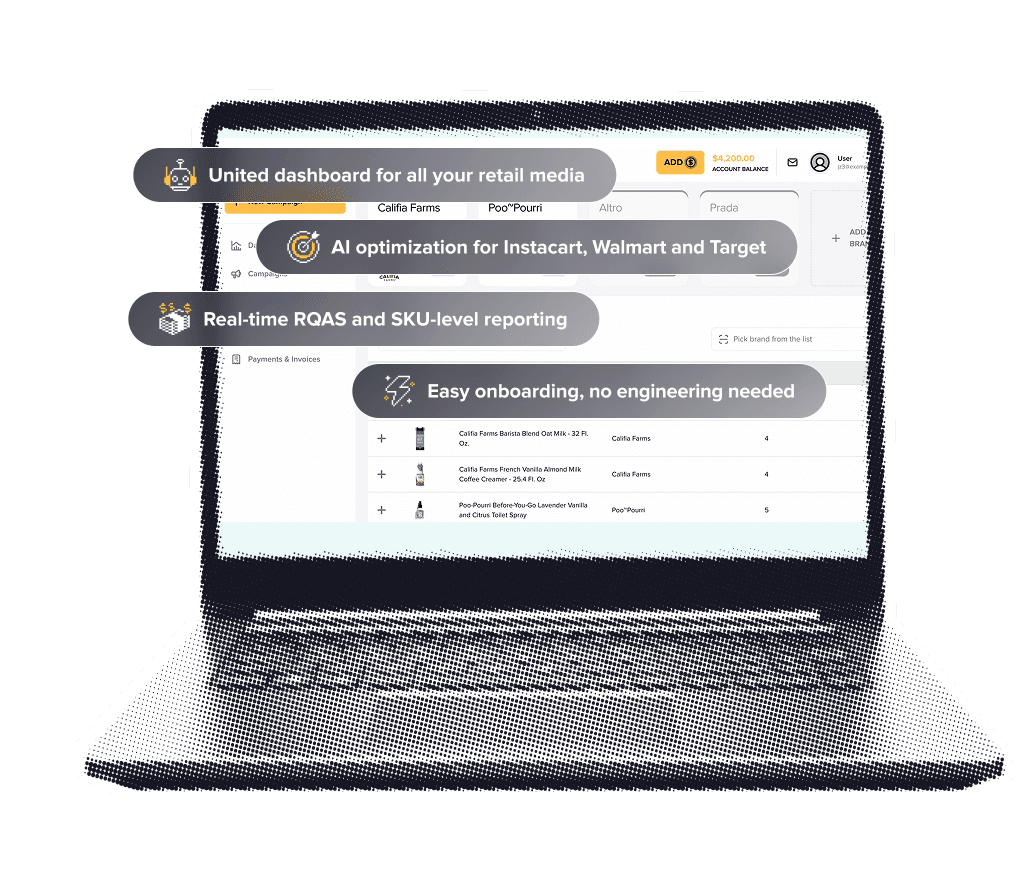

Accelerate payback periods by consolidating retail media execution on RMIQ’s unified, AI-driven platform, which compresses time-to-value through autonomous optimization and real-time cross-network learning. By replacing fragmented dashboards across Walmart, Instacart, Amazon, Target, Sprouts, Thrive Market, and Uber with a single interface, RMIQ reduces operational drag, shortens analysis cycles, and channels spend toward the highest-yielding SKUs and keywords sooner. Its multi-agent architecture dynamically orchestrates bid adjustments, budget reallocation, A/B test sequencing, and strategy refinement, continuously adapting to market signals without manual lag, leading to average ROAS gains exceeding 50% and up to five dollars in incremental sales per dollar invested. This performance lift translates directly into faster breakeven on media investments as wasted impressions decline and profitable conversions scale earlier in the campaign lifecycle.

With coverage that reaches up to 85% of the U.S. retail audience across twenty-plus networks, RMIQ widens the addressable demand surface while maintaining precision via SKU-level insights and keyword optimization, enabling rapid identification of winning pockets of demand that accelerate revenue recapture. Implementation friction is minimal—onboarding can be completed in minutes—so teams realize impact quickly, avoiding protracted integration timelines that dilute payback. Centralized reporting and workflow automation further compress cycle times by eliminating manual data stitching and enabling daily, even intraday, optimizations that compound results.

For enterprises managing thousands of SKUs as well as emerging brands, RMIQ scales controls and governance without slowing decision velocity, ensuring financial stakeholders gain earlier visibility into break-even trajectories and cash efficiency. In sum, by unifying execution, enriching signal quality, and automating high-frequency decisions, RMIQ shortens the path from spend to measurable return, improving payback periods while preserving brand control and strategic flexibility. This creates predictable, defensible cash flows, accelerates reinvestment cycles, and equips executives with transparent, audit-ready reporting to validate ROI, align budgeting, and scale what works across markets and regions.

With coverage that reaches up to 85% of the U.S. retail audience across twenty-plus networks, RMIQ widens the addressable demand surface while maintaining precision via SKU-level insights and keyword optimization, enabling rapid identification of winning pockets of demand that accelerate revenue recapture. Implementation friction is minimal—onboarding can be completed in minutes—so teams realize impact quickly, avoiding protracted integration timelines that dilute payback. Centralized reporting and workflow automation further compress cycle times by eliminating manual data stitching and enabling daily, even intraday, optimizations that compound results.

For enterprises managing thousands of SKUs as well as emerging brands, RMIQ scales controls and governance without slowing decision velocity, ensuring financial stakeholders gain earlier visibility into break-even trajectories and cash efficiency. In sum, by unifying execution, enriching signal quality, and automating high-frequency decisions, RMIQ shortens the path from spend to measurable return, improving payback periods while preserving brand control and strategic flexibility. This creates predictable, defensible cash flows, accelerates reinvestment cycles, and equips executives with transparent, audit-ready reporting to validate ROI, align budgeting, and scale what works across markets and regions.

Skills and tools for Payback Period

To calculate the payback period, you need basic financial skills like understanding cash flows, investment costs, and time value of money. Tools such as spreadsheets (Excel, Google Sheets) or financial calculators are essential for organizing data and performing calculations quickly and accurately.

Our Current Partners

We are already helping leading retailers and platforms grow their retail media businesses, including:

Drop your email

and we’ll show you how to double your retail media ROAS – no strings attached