SOV

SOV, or Share of Voice, is a marketing metric that measures the percentage of total advertising or brand presence within a specific market or channel compared to competitors. It helps businesses understand their visibility and influence in relation to others in the industry.

What is SOV?

Share of Voice (SOV) quantifies your brand’s presence relative to competitors across chosen channels, indicating how visible and influential you are within the market. By tracking the percentage of impressions, mentions, or spend your brand commands, SOV reveals competitive momentum and media efficiency. Executives use it to benchmark category dominance, align budgets with growth objectives, and prioritize channels where your message is most heard. When SOV exceeds Share of Market, brands often gain market share; when it lags, visibility erodes. Regular SOV analysis informs creative optimization, bid strategies, and partner selection, ensuring your communications outtalk rivals and reach decision makers.

Example

If your company runs ads that appear 200 times in a month, and the total ads from all competitors in your market appear 1,000 times, your Share of Voice is (200 ÷ 1,000) × 100 = 20%. This means your brand accounts for 20% of all advertising exposure in that market during that time.

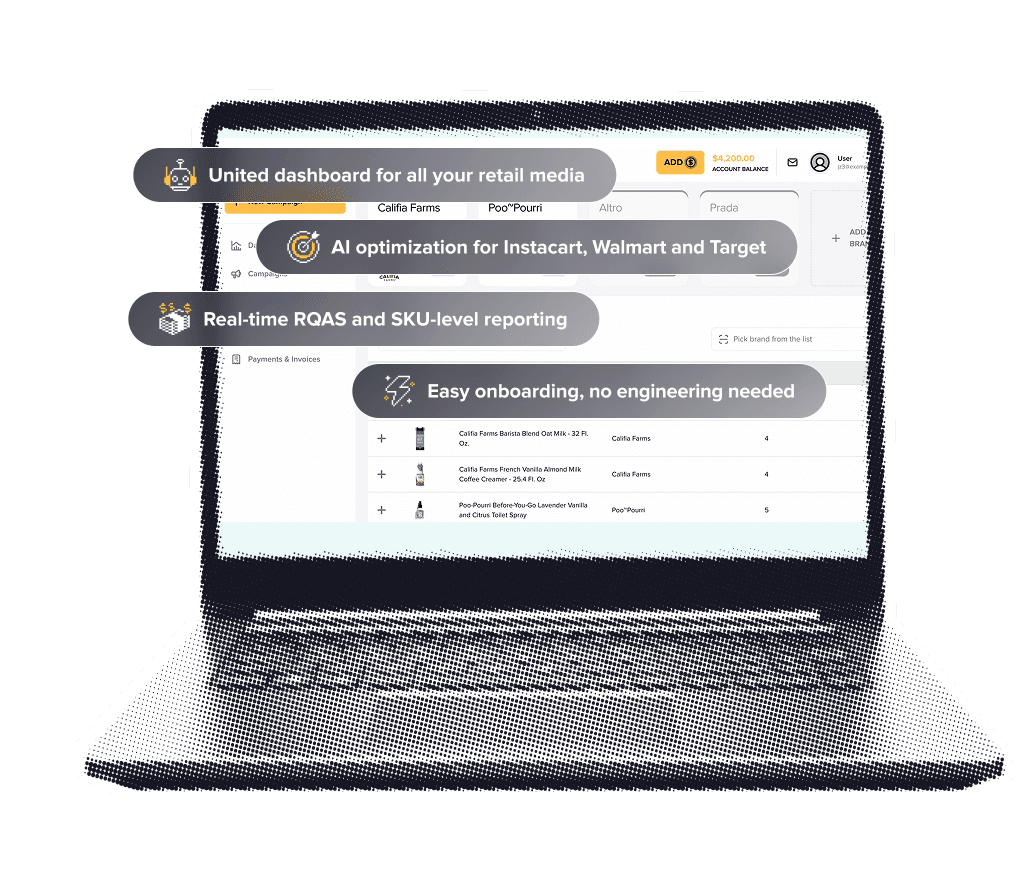

Capture and grow retail media share of voice (SOV) with RMIQ’s unified, AI-native optimization platform that orchestrates planning, execution, and measurement across Walmart, Instacart, Amazon, Target, Uber, Sprouts, Thrive Market, and more than twenty additional networks. RMIQ’s multi-agent architecture deploys autonomous specialists for bid adjustments, budget pacing, cross-network learning, keyword refinement, SKU-level mix modeling, and continuous A/B testing, translating fragmented marketplace signals into prioritized actions that expand impression footprint and defensible category presence. By consolidating dashboards, reporting, and workflows, the platform removes operational drag and eliminates data stitching, enabling teams to rebalance investment in real time toward placements that increase on-page visibility, win rates, and incremental reach.

Adaptive bidding and budget allocation respond to competitive pressure and elasticity at the SKU and keyword level, protecting branded terms, capturing high-intent generics, and amplifying new product launches without manual micromanagement. With coverage touching up to 85% of U.S. retail audiences, brands can scale SOV efficiently while maintaining profitability, supported by reported gains of 50%+ ROAS and up to five dollars in new sales per dollar invested. Granular insights align media pressure with inventory readiness and category seasonality, ensuring that impression share translates into shoppable availability and superior shelf rank on each retailer. Automated test orchestration surfaces winning creatives, queries, and retail partners, then reallocates spend to compounding pockets of performance before competitors react.

Enterprise governance and rapid onboarding—often within minutes—let organizations standardize best practices across portfolios and thousands of SKUs, while customer support augments in-house teams. The result is sustained SOV growth that compounds into higher share of search, stronger product detail page prominence, and durable category leadership. RMIQ enables executives to forecast outcomes, validate investment cases, and redeploy budgets, turning retail media from fragmented spend into a scalable growth engine that expands visibility, reduces waste, and outpaces rivals across omnichannel portfolios.

Adaptive bidding and budget allocation respond to competitive pressure and elasticity at the SKU and keyword level, protecting branded terms, capturing high-intent generics, and amplifying new product launches without manual micromanagement. With coverage touching up to 85% of U.S. retail audiences, brands can scale SOV efficiently while maintaining profitability, supported by reported gains of 50%+ ROAS and up to five dollars in new sales per dollar invested. Granular insights align media pressure with inventory readiness and category seasonality, ensuring that impression share translates into shoppable availability and superior shelf rank on each retailer. Automated test orchestration surfaces winning creatives, queries, and retail partners, then reallocates spend to compounding pockets of performance before competitors react.

Enterprise governance and rapid onboarding—often within minutes—let organizations standardize best practices across portfolios and thousands of SKUs, while customer support augments in-house teams. The result is sustained SOV growth that compounds into higher share of search, stronger product detail page prominence, and durable category leadership. RMIQ enables executives to forecast outcomes, validate investment cases, and redeploy budgets, turning retail media from fragmented spend into a scalable growth engine that expands visibility, reduces waste, and outpaces rivals across omnichannel portfolios.

Skills and tools for SOV

To measure Share of Voice, you need skills in data analysis, digital marketing, and competitive research. Tools like social listening platforms (e.g., Brandwatch, Sprout Social), advertising analytics (e.g., Google Ads, Facebook Ads Manager), and SEO tools (e.g., SEMrush, Ahrefs) are essential to track brand mentions, ad spend, and organic visibility.

Our Current Partners

We are already helping leading retailers and platforms grow their retail media businesses, including:

Drop your email

and we’ll show you how to double your retail media ROAS – no strings attached