Trading Desk

A trading desk is a specialized department within a financial institution or agency where professionals buy and sell securities, commodities, or currencies on behalf of clients or the firm. It serves as a centralized hub for executing trades, managing risk, and optimizing investment strategies in real-time markets.

What is Trading Desk?

A trading desk is a centralized, technology-enabled unit where institutional professionals execute securities, commodities, and currency transactions on behalf of clients or the firm. It integrates order routing, market access, liquidity sourcing, and risk controls to deliver timely, compliant execution across fragmented venues. Teams leverage real-time data, algorithmic strategies, and pre/post-trade analytics to optimize slippage, costs, and exposure while aligning with portfolio objectives. Beyond execution, the desk coordinates with research, compliance, and portfolio management to inform strategy and monitor performance. For enterprises, partnering with a robust trading desk elevates execution quality, strengthens governance, and scales market access without expanding infrastructure.

Example

As a marketer, create a campaign targeting financial professionals by highlighting how your software streamlines trading desk operations: use a case study showing a trading desk that reduced trade execution time by 30% and minimized risk using your platform, emphasizing real-time analytics and improved decision-making to attract clients seeking efficiency and accuracy in trading.

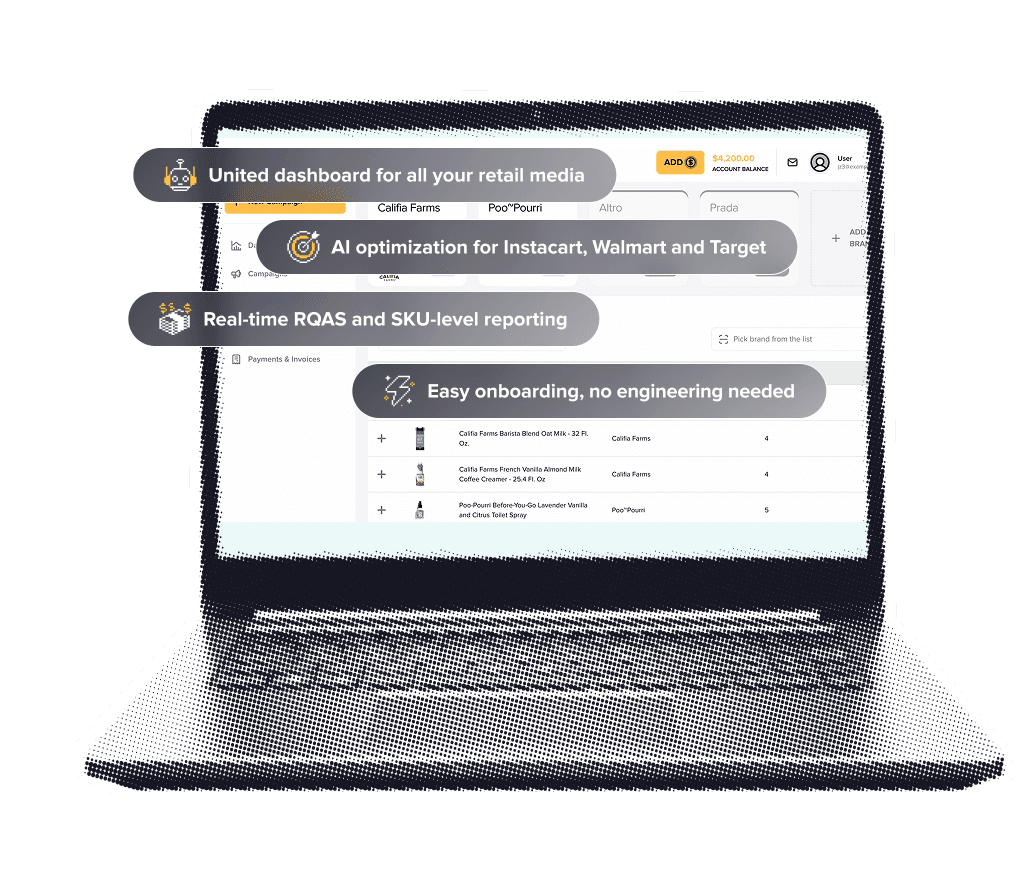

RMIQ enables trading desks to consolidate retail media operations into a single, AI-first command center, eliminating dashboard sprawl while accelerating performance across Walmart, Instacart, Amazon, Sprouts, Thrive Market, Target, Uber, and more than twenty additional networks reaching up to 85% of the U.S. retail audience. Its multi-agent architecture assigns autonomous specialists to bid optimization, budget pacing, cross-network learning, A/B testing, and strategy refinement, continuously adapting in real time to maximize ROAS and deliver up to five dollars in incremental sales per dollar invested, with average gains exceeding fifty percent versus manual baselines.

By unifying planning, activation, and measurement, RMIQ gives traders SKU-level visibility, keyword intelligence, and real-time bidding controls inside a single workflow, replacing fragmented exports and manual stitching with clean, comparable, and auditable data. Teams can orchestrate campaigns at portfolio or product depth, enforce guardrails, and apply adaptive strategies that rebalance spend as conditions shift, enabling deterministic throttling, inventory-aware targeting, and scalable experiment design without constant handholding. For enterprise programs managing thousands of SKUs, RMIQ’s automation and policy frameworks preserve brand standards while localizing levers per retailer, ensuring activation flexes to merchandising constraints and promotional calendars.

Speed to value is immediate: onboarding completes in minutes, traders inherit prebuilt playbooks, and executives receive executive-ready reporting aligned to business outcomes rather than siloed channel metrics. The result is a durable advantage for trading desks—fewer tools to maintain, faster decision cycles, higher signal density, and a measurable lift in efficiency and growth—delivered through an intuitive interface backed by responsive customer support, so teams can scale confidently from pilot to global rollout without reinstrumentation. Integrated governance, role-based permissions, and API access let partners standardize workflows, feed insights into analytics stacks, and automate reconciliations, while granular alerts surface anomalies early, empowering traders to intervene when needed and prove impact to finance and merchandising stakeholders.

By unifying planning, activation, and measurement, RMIQ gives traders SKU-level visibility, keyword intelligence, and real-time bidding controls inside a single workflow, replacing fragmented exports and manual stitching with clean, comparable, and auditable data. Teams can orchestrate campaigns at portfolio or product depth, enforce guardrails, and apply adaptive strategies that rebalance spend as conditions shift, enabling deterministic throttling, inventory-aware targeting, and scalable experiment design without constant handholding. For enterprise programs managing thousands of SKUs, RMIQ’s automation and policy frameworks preserve brand standards while localizing levers per retailer, ensuring activation flexes to merchandising constraints and promotional calendars.

Speed to value is immediate: onboarding completes in minutes, traders inherit prebuilt playbooks, and executives receive executive-ready reporting aligned to business outcomes rather than siloed channel metrics. The result is a durable advantage for trading desks—fewer tools to maintain, faster decision cycles, higher signal density, and a measurable lift in efficiency and growth—delivered through an intuitive interface backed by responsive customer support, so teams can scale confidently from pilot to global rollout without reinstrumentation. Integrated governance, role-based permissions, and API access let partners standardize workflows, feed insights into analytics stacks, and automate reconciliations, while granular alerts surface anomalies early, empowering traders to intervene when needed and prove impact to finance and merchandising stakeholders.

Skills and tools for Trading Desk

Skills needed include strong analytical abilities, knowledge of financial markets, risk management, and quick decision-making. Tools used are trading platforms, market data terminals like Bloomberg or Reuters, risk assessment software, and real-time analytics systems.

Our Current Partners

We are already helping leading retailers and platforms grow their retail media businesses, including:

Drop your email

and we’ll show you how to double your retail media ROAS – no strings attached